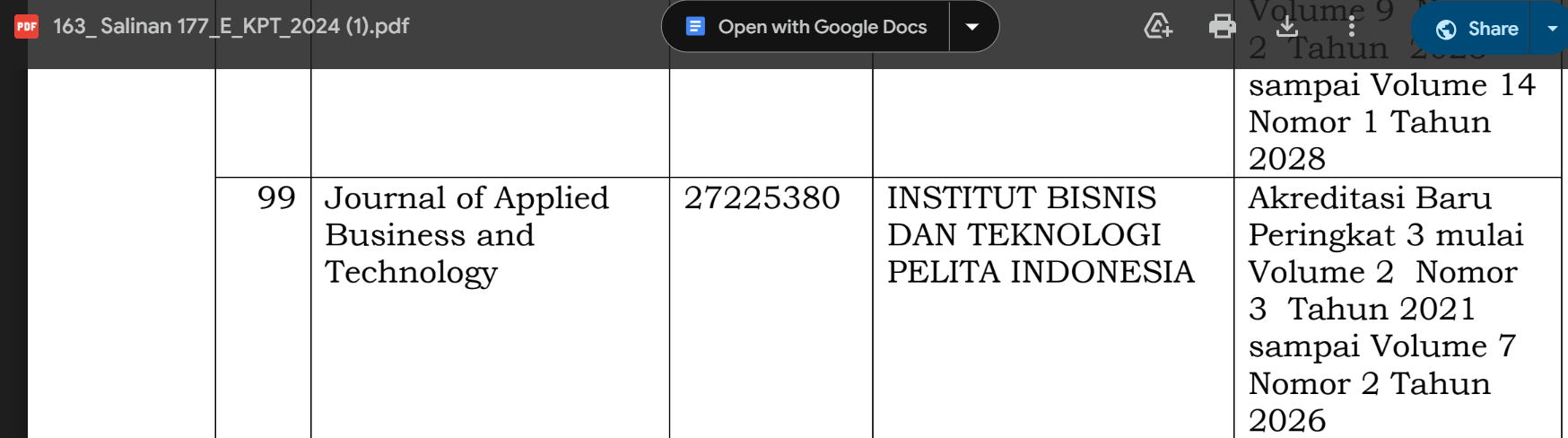

Quality of Socialization, Services, and Electronic Services on Taxpayer Satisfaction and Taxpayer Compliance at Kantor Pelayanan Pajak Madya Pekanbaru

DOI:

https://doi.org/10.35145/jabt.v3i3.113Keywords:

Quality of Socialization, Quality of Service, Quality of Electronic Services, Taxpayer Satisfaction, Taxpayer ComplianceAbstract

The purpose of this study is to analyze and determine the effect of socialization quality, service quality, and electronic service quality on taxpayer satisfaction and taxpayer compliance. The population in question is taxpayers who are registered with the KPP Madya Pekanbaru and have the obligation to report the Annual Income Tax Return using e-filing, totaling 829 taxpayers. The sample was used using the Slovin formula calculation of as many as 109 respondents. The data analysis technique in this study used descriptive analysis and Structural Equation Model – Partial Least Square (SEM-PLS) analysis with the help of Smart PLS software. The results of this study indicate that the quality of service and the quality of electronic services is significantly positive for taxpayer satisfaction and socialization quality is positively not significant for taxpayer satisfaction. Quality of socialization, quality of service, quality of electronic services, and taxpayer satisfaction are positive but not significant on taxpayer compliance.

References

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211. https://doi.org/10.1016/0749-5978(91)90020-T

Andreoni, J., Erard, B., & Feinstein, J. (1998). Tax Compliance. Journal of Economic Literature, XXXVI(2), 818–860.

Ardiyansyah, A., Kertahadi, & Dewantara, R. Y. (2016). Pengaruh Pelayanan Fiskus terhadap Kepatuhan Wajib Pajak melalui Kepuasan Wajib Pajak (Studi pada Wajib Pajak di Wilayah Kerja KPP Pratama Blitar). Jurnal Perpajakan (JEJAK), 11(1), 1–10.

Arif, I., Komardi, D., & Putra, R. (2021). Brand Image, Educational Cost, and Facility on Student Satisfaction and Loyalty at STIE Pelita Indonesia. Journal of Applied Business and Technology, 2(2), 118–133.

Arsyad, M. (2013). Analisis Pengaruh Sosialisasi, Pemeriksaan, Dan Penagihan Aktif Terhadap Kesadaran Pajak Dan Kepatuhan Wajib Pajak Badan Di Kantor Pelayanan Pajak Pratama Medan Timur. Tesis, 1–253.

Bahri, S., Diantimala, Y., & Majid, M. (2019). Pengaruh Kualitas Pelayanan Pajak, Pemahaman Peraturan Perpajakan Serta Sanksi Perpajakan Terhadap Kepatuhan Wajib Pajak (Pada Kantor Pajak KPP Pratama Kota Banda Aceh). Jurnal Perspektif Ekonomi Darussalam, 4(2), 318–334. https://doi.org/10.24815/jped.v4i2.13044

Chandra, T., Renaldo, N., & Putra, L. C. (2018). Stock Market Reaction towards SPECT Events using CAPM Adjusted Return. Opción, Año 34(Especial No.15), 338–374.

Davis, F. D. (1985). A technology acceptance model for empirically testing new end-user information systems: Theory and results. Management, Ph.D.(January 1985), 291. https://doi.org/oclc/56932490

Fajri, D., Chandra, T., & Putra, R. (2021). The Influence of Brand Image and Promotion on the Decisions of Students in STIE Mahaputra Riau with Learning Interest as Intervening. Journal of Applied Business and Technology, 2(3), 223–232.

Farida, A. (2017). Tax compliance mystery. Journal FEB UNMUL, 14(2), 122–128.

Ghozali, I. (2016). Aplikasi Analisis Multivariate dengan Program IBM SPSS 23. Badan Penerbit Fakultas Ekonomi Universitas Diponegoro.

Hafni, L., Renaldo, N., Chandra, T., & Thaief, I. (2020). The Use of Regression Models with Supply Chain Management to Increase Financial Satisfaction of Generation Z. International Journal of Supply Chain Management, 9(5), 1641–1650.

Hidayat, A., Chandra, T., & Putra, R. (2022). Service Quality on Consumer Satisfaction and Non-Wage Consumer Loyalty in BPJS Ketenagakerjaan Pekanbaru Panam Branch. Journal of Applied Business and Technology, 3(2), 166–176.

Jacksen, Chandra, T., & Putra, R. (2021). Service Quality and Brand Image on Customer Satisfaction and Customer Loyalty at Pesonna Hotel Pekanbaru. Journal of Applied Business and Technology, 2(2), 142–153.

Karim, H. (2015). Pengaruh Sosialisasi Perpajakan, Kualitas Pelayanan Fiskus, dan Sanksi Perpajakan terhadap Kinerja Kantor Pelayanan Pajak (KPP) dengan Kepatuhan Wajib Pajak sebagai Variabel Intervening di KPP Pratama Medan Belawan.

Mardiasmo. (2016). Perpajakan Edisi Revisi Tahun 2016. Andi.

Migacz, S. J., Zou, S., & Petrick, J. F. (2018). The “terminal” effects of service failure on airlines: Examining service recovery with justice theory. Journal of Travel Research. https://doi.org/10.1177/0047287516684979

Muehlbacher, S., & Kirchler, E. (2010). Tax compliance by trust and power of authorities. International Economic Journal, 24(4), 607–610. https://doi.org/10.1080/10168737.2010.526005

Muflih, M. (2017). Pengaruh Kesadaran Wajib Pajak, Kualitas Pelayanan Fiskus, Penyuluhan Wajib Pajak, dan Sanksi Perpajakan terhadap Kepatuhan Wajib Pajak Orang Pribadi pada KPP Pratama Medan Kota.

Munawir, S. (1998). Pokok-Pokok Perpajakan. Liberty.

Mustapha, B., & Obid, S. N. B. S. (2015). Tax Service Quality: The Mediating Effect of Perceived Ease of Use of the Online Tax System. Procedia - Social and Behavioral Sciences, 172, 2–9. https://doi.org/10.1016/j.sbspro.2015.01.328

Nautami, D. T., & Wahid, F. (2019). Penerapan Metode E-Govqual Untuk Mengevaluasi. Prosiding Seminar Nasional Geotik, 325–334. www.ntbprov.go.id.

Nurmantu, S. (2005). Pengantar Perpajakan (3rd ed.). Granit.

Panjaitan, H. P., Renaldo, N., & Suyono. (2022). The Influence of Financial Knowledge on Financial Behavior and Financial Saisfaction on Pelita Indonesia Students. Jurnal Manajemen Indonesia, 22(2), 145–153. https://doi.org/10.25124/jmi.v22i1.4289

Rara Susmita, P., & Supadmi, N. (2016). Pengaruh Kualitas Pelayanan, Sanksi Perpajakan, Biaya Kepatuhan Pajak, Dan Penerapan E-Filing Pada Kepatuhan Wajib Pajak. E-Jurnal Akuntansi, 14(2), 1239–1269.

Renaldo, N., Jollyta, D., Suhardjo, Fransisca, L., & Rosyadi, M. (2022). Pengaruh Fungsi Sistem Intelijen Bisnis terhadap Manfaat Sistem Pendukung Keputusan dan Organisasi. Jurnal Informatika Kaputama, 6(3), 61–78.

Renaldo, N., Putra, R., Suhardjo, Suyono, & Putri, I. Y. (2022). Strategi Menurunkan Turnover Intention Akuntan Pada Kantor Jasa Akuntansi Pekanbaru Tahun 2021. Jurnal Aplikasi Bisnis Dan Manajemen, 8(2), 588–600. https://doi.org/10.17358/jabm.8.2.588

Renaldo, N., Sudarno, Hutahuruk, M. B., Junaedi, A. T., Andi, & Suhardjo. (2021). The Effect of Entrepreneurship Characteristics, Business Capital, and Technological Sophistication on MSME Performance. Journal of Applied Business and Technology, 2(2), 109–117.

Renaldo, N., Suhardjo, Putri, I. Y., Sevendy, T., & Juventia, J. (2021). Penilaian Harga Saham Berbasis Web pada Perusahaan Sektor Aneka Industri Tahun 2020. Kurs: Jurnal Akuntansi, Kewirausahaan Dan Bisnis, 6(1), 91–102. http://www.ejournal.pelitaindonesia.ac.id/ojs32/index.php/KURS/article/view/1309/711

Renaldo, N., Suharti, Andi, Putri, N. Y., & Cecilia. (2021). Accounting Information Systems Increase MSMEs Performance. Journal of Applied Business and Technology, 2(3), 261–270.

Ritonga, P. (2011). Analisis Pengaruh Kesadaran dan Kepatuhan Wajib Pajak Terhadap Kinerja Kantor Pelayanan Pajak (KPP) dengan Pelayanan Wajib Pajak Sebagai Variabel Intervening di KPP Medan Timur. Tesis, 1–93.

Sisilia, M. (2016). Faktor-Faktor Yang Mempengaruhi Tingkat Kepatuhan Wajib Pajak Orang Pribadi di Kantor Pelayanan Pajak Pratama Semarang Selatan Tahun 2019 (Issue 1). https://doi.org/10.31294/moneter.v7i1.7632

Stiglingh, M. (2014). A measuring instrument to evaluate e-service quality in a revenue authority setting. Public Relations Review, 40(2), 216–225. https://doi.org/10.1016/j.pubrev.2013.12.001

Sudarno, Putri, N. Y., Renaldo, N., Hutahuruk, M. B., & Cecilia. (2022). Leveraging Information Technology for Enhanced Information Quality and Managerial Performance. Journal of Applied Business and Technology, 3(1), 102–114.

Suharto. (2011). Pengaruh Kepuasan Wajib Pajak Terhadap Kepatuhan Wajib Pajak. Derivative, 5(1), 82–85.

Sulistyorini, M., Nurlaela, S., & Chomsatu, Y. (2017). Pengaruh penggunaan sistem administrasi e-registration, e-billing, e-spt, Dan e-filling terhadap kepatuhan wajib pajak. Jurnal.Unimus.Ac.Id, 1–9. https://jurnal.unimus.ac.id/index.php/psn12012010/article/view/2318

Tarjo, & Kusumawati, I. (2006). Analisis perilaku wajib pajak orang pribadi terhadap pelaksanaan self assessment system suatu studi di Bangkalan. Jurnal Akuntansi & Auditing Indonesia, 10(1), 101–120.

Tiraada, T. A. M. (2013). Kesadaran Perpajakan, Sanksi Pajak, Sikap Fiskus Terhadap Kepatuhan Wpop Di Kabupaten Minahasa Selatan. Jurnal Emba, 1(3), 999–1008.

Wang, Y., Zhang, Z., Zhu, M., & Wang, H. (2020). The Impact of Service Quality and Customer Satisfaction on Reuse Intention in Urban Rail Transit in Tianjin, China. Sage Open, 1–10. https://doi.org/10.1177/2158244019898803

Wulanjayanti, T., & Usman, D. (2019). the Effect of Service Quality of Electronic Taxing System and Tax Employee Competence on Taxpayer Satisfaction. Jurnal Akuntansi, 7(2), 87–100. https://doi.org/10

Wren, G. P., Daly, M., & Burstein, F. (2021). Reconciling business intelligence, analytics and decision support systems: More data, deeper insight. Decision Support Systems, 146(113560), 1–13. https://doi.org/10.1016/j.dss.2021.113560

Yusrizal, Renaldo, N., & Hasri, M. O. (2021). Pengaruh Good Governance dan Whistleblowing System terhadap Kepatuhan Wajib Pajak Orang Pribadi dengan Risiko Sanksi Pajak sebagai Moderasi di KPP Pratama Pekanbaru Tampan. Bilancia: Jurnal Ilmiah Akuntansi, 5(2), 119–134.