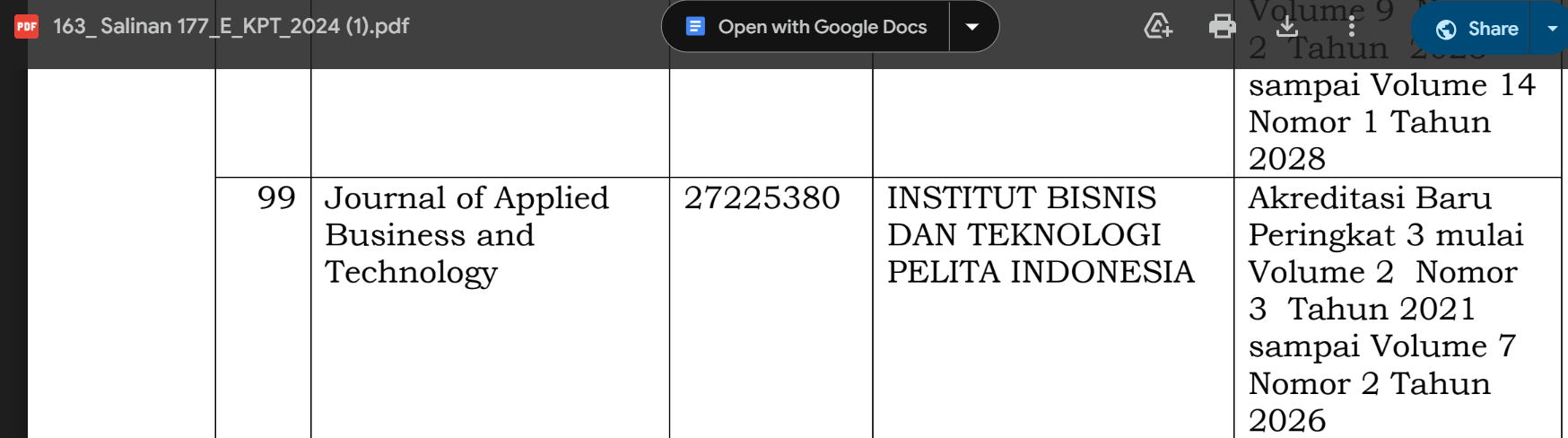

Literature Review: Mediation Effects of Debt Maturity on Good Corporate Governance in Enhancing Financial Performance

DOI:

https://doi.org/10.35145/jabt.v4i2.125Keywords:

Debt Maturity, Good Corporate Governance, Financial PerformanceAbstract

This study proposes a research model to investigate the mediating effect of debt maturity on the relationship between good corporate governance (GCG) and financial performance. The qualitative approach employed is a systematic literature review (SLR) technique, analyzing 11 articles selected from 142 related ones found on the Google Scholar database within the 2010-2021 research range based on inclusion and exclusion criteria. Debt maturity was found to play a crucial role in shaping the effectiveness of GCG mechanisms in managing financial risks and improving financial performance. The proposed research model has implications for researchers and practitioners, providing a basis for future empirical studies exploring the interplay between GCG, debt maturity, and financial performance. For practitioners, it offers a theoretical framework for developing policies and practices promoting effective GCG and optimal debt maturity structures to enhance financial performance. The findings inform the development of policies and procedures that promote good corporate governance and optimal debt maturity structures, leading to improved financial performance. Additionally, the proposed research model may be applied to other contexts, contributing to a better understanding of the role of debt maturity in the relationship between GCG and financial performance.

References

Abadi, S., Murhadi, W. R., & Sutejo, B. S. (2014). Faktor-faktor yang Mempengaruhi Debt Maturity di Sektor Industri Manufaktur yang Terdaftar di Bursa Efek Indonesia Periode 2008-2012. CALYPTRA, 2(2), 1–10.

Aggarwal, P. (2013). Impact of Corporate Governance on Corporate Financial Performance. Journal of Business and Management, 13(3), 1–5.

Akasumbawa, M. D. D., & Haryono, S. (2021). Pengaruh Kualitas Laporan Keuangan Dan Debt Maturity Terhadap Efisiensi Investasi Dengan Good Corporate Governance Sebagai Variabel Moderasi: Studi Pada Perbankan Go Public Di Indonesia. PERFORMANCE: Jurnal Bisnis & Akuntansi, 11(1), 28–42.

Aulia, D., & Siregar, S. V. (2018). Financial reporting quality, debt maturity, and chief executive officer career concerns on investment efficiency. BAR-Brazilian Administration Review, 15(2), 1–16.

Banga, R., & Sinha, U. B. (2005). Does the structure of debt affect the output and investment strategies of the firm? Journal of Restructuring Finance, 2(02), 157–172.

Barnes, R. M., & Barnes, J. R. (1980). Motion and Time Study: Design and Measurement of Work. John Wiley & Sons, Inc.

Damarjati, A., Akuntansi, D., Ekonomika, F., Diponegoro, U., Prof, J., & Sh, S. (2019). Pengaruh Leverage, Debt Maturity, Kebijakan Dividen, Dan Cash Holdings Terhadap Kinerja Keuangan Perusahaan (Studi Pada Perusahaan Manufaktur Yang Terdaftar Di Bei Tahun 2017). Diponegoro Journal of Accounting, 7(4), 1–12

D’Mello, R., & Miranda, M. (2010). Long-term debt and overinvestment agency problem. Journal of Banking & Finance, 34(2), 324–335.

De Roon, F., & Veld, C. (1998). Announcement effects of convertible bond loans and warrant-bond loans: An empirical analysis for the Dutch market. Journal of Banking & Finance, 22(12), 1481–1506.

Guha-Khasnobis, B., & Bhaduri, S. N. (2002). Determinants of capital structure in India (1990-1998): a dynamic panel data approach. Journal of Economic Integration, 17(4), 761–776.

Hasan, M. M., Asad, S., & Wong, J. B. (2022). Oil price uncertainty and corporate debt maturity structure. Finance Research Letters, 46, 1–19.

Hermiyetti, H., & Manik, E. N. (2013). The Influence of Good Corporate Governance Mechanism on Earnings Management: Empirical Study in Indonesian Stock Exchange Listed Company for Periods of 2006-2010. Indonesian Capital Market Review, 5(1). https://doi.org/10.21002/icmr.v5i1.1583

Hu, Y., Varas, F., & Ying, C. (2021). Debt Maturity Management. Working Paper.

Huyghebaert, N., & Wang, L. (2016). Institutional development and financing decisions: Evidence from a cross-regional study on Chinese listed firms. The European Journal of Finance, 22(4–6), 288–318.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review, 76(2), 323–329.

Kautsar, A., & Kusumaningrum, T. M. (2015). Analisis Pengaruh Good Coorporate Governance Terhadap Kinerja Perusahaan Yang Dimediasi Struktur Modal Pada Perusahaan Pertambangan Yang Listed Di Bei 2009-2012. Jurnal Riset Ekonomi Dan Manajemen, 15(1), 59. https://doi.org/10.17970/jrem.15.150105.id

Khan, N., Ullah, H., & Afeef, M. (2021). The Effect of Leverage and Debt Maturity on the Corporate Financial Performance: Evidence from Non Financial Firms Listed at Pakistan Stock Exchange. Sustainable Business and Society in Emerging Economies, 3(1), 35–47. https://doi.org/10.26710/sbsee.v3i1.1829

Kim, H. (2015). Debt, maturity, and corporate governance: Evidence from Korea. Emerging Markets Finance and Trade, 51(July), 3–19. https://doi.org/10.1080/1540496X.2015.1039898

Kiteley, R., & Stogdon, C. (2013). Literature Reviews in Social Work. SAGE Publications.

Liem, N. T. (2020). Short Term Debt Maturity, Real Earnings Management and Firm Performance. The Empirical Economics Letters, 19(4), 261–267.

Mahrani, M., & Soewarno, N. (2018). The effect of good corporate governance mechanism and corporate social responsibility on financial performance with earnings management as mediating variable. Asian Journal of Accounting Research, 3(1), 41–60. https://doi.org/10.1108/AJAR-06-2018-0008

Makki, M. A. M., & Lodhi, S. A. (2013). Impact of corporate governance on financial performance of information technology companies. Pakistan Journal of Social Sciences, 33(2), 265–280. https://doi.org/10.35940/ijrte.C5603.098319

Marfuah, M., & Endaryati, H. (2016). Pengaruh Good Corporate Governance Dan Debt Maturity Terhadap Prediksi Bond Rating. EKUITAS (Jurnal Ekonomi Dan Keuangan), 20(4), 434–454.

Mitra, S., Hossain, M., & Deis, D. R. (2007). The empirical relationship between ownership characteristics and audit fees. Review of Quantitative Finance and Accounting, 28(3), 257–285.

Myers, S. C. (1977). Determinants Of Corporate Borrowing. Journal of Financial Economics, 5, 147–175.

Nguyen, V. H., Choi, B., & Agbola, F. W. (2020). Corporate social responsibility and debt maturity: Australian evidence. Pacific Basin Finance Journal, 62, 101374. https://doi.org/10.1016/j.pacfin.2020.101374

Nunes, P. M., Serrasqueiro, Z., & Leitão, J. (2013). Assessing the nonlinear nature of the effects of R&D intensity on growth of SMEs: A dynamic panel data approach. Journal of Evolutionary Economics, 23(1), 97–128. https://doi.org/10.1007/s00191-011-0258-9

Perry, A., & Hammond, N. (2002). Systematic reviews: The experiences of a PhD student. Psychology Learning & Teaching, 2(1), 32–35.

Prasinta, D. (2012). Pengaruh Good Corporate Governance Terhadap Kinerja Keuangan. Accounting Analysis Journal, 1(2), 1–7.

Sari, L. I. N., & Suaryana, I. (2014). The Effect of quality of financial statements on investment efficiency of mining companies. E-Jurnal Akuntansi Universitas Udayana, 8(3), 524–537.

Titman, S., & Wessels, R. (1988). The determinants of capital structure choice. The Journal of Finance, 43(1), 1–19.

Vătavu, S. (2015). The impact of capital structure on financial performance in Romanian listed companies. Procedia Economics and Finance, 32, 1314–1322.

Vithessonthi, C., & Tongurai, J. (2015). The effect of leverage on performance: Domestically-oriented versus internationally-oriented firms. Research in International Business and Finance, 34, 265–280.

Wahba, H. (2013). Debt and financial performance of smes: The missing role of debt maturity structure. Corporate Ownership and Control, 10(3 D,CONT3), 266–277. https://doi.org/10.22495/cocv10i3c3art2

Wahyudin, A., & Solikhah, B. (2017). Corporate governance implementation rating in Indonesia and its effects on financial performance. Corporate Governance: The International Journal of Business in Society, 17(2), 250–265. https://doi.org/10.1108/CG-02-2016-0034

Widhianningrum, P., & Amah, N. (2021). Pengaruh Mekanisme Good Corporate Governance Terhadap Kinerja Keuangan Selama Krisis Keuangan Tahun 2007-2009. Jurnal Dinamika Akuntansi, 4(2), 94–102.

Yassir Hussain, R., Xuezhou, W., Hussain, H., Saad, M., & Qalati, S. A. (2021). Corporate board vigilance and insolvency risk: a mediated moderation model of debt maturity and fixed collaterals. International Journal of Management and Economics, 57(1), 14–33. https://doi.org/10.2478/ijme-2020-0032

Zeitun, R., & Tian, G. G. (2014). Capital structure and corporate performance: evidence from Jordan. Australasian Accounting Business & Finance Journal, Forthcoming, 1(4), 40–61.