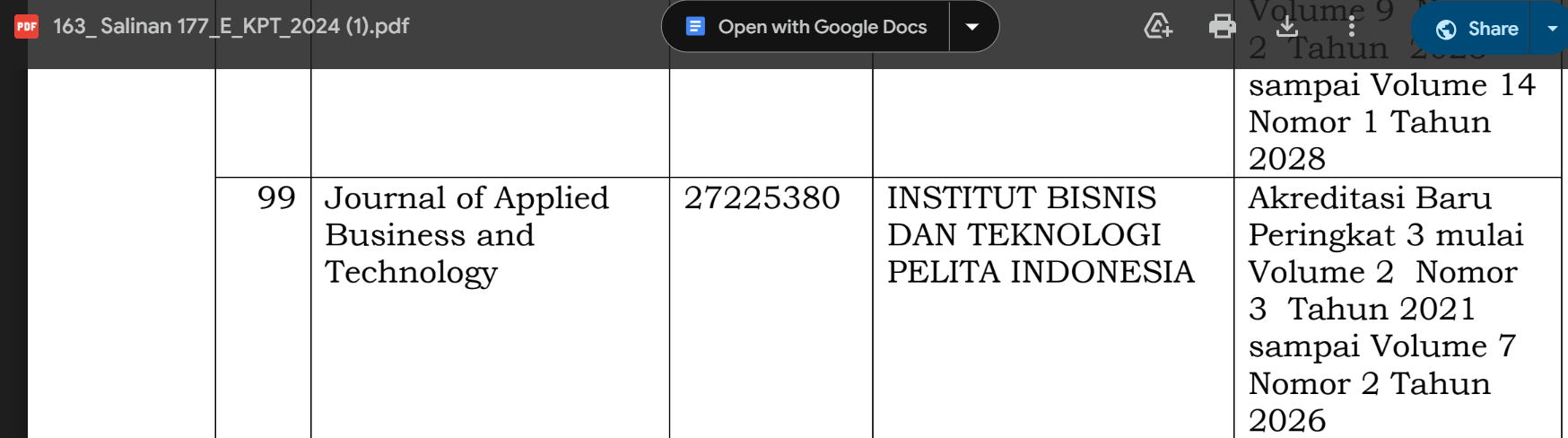

The Effect of Profit Persistency, Business Risk and Capital Structure on Earnings Return Coefficient with Good Corporate Governance as Moderating Variable

DOI:

https://doi.org/10.35145/jabt.v5i1.158Keywords:

Profit Persistence, Business Risk, Capital Structure, GCG, ERCAbstract

This research aims to analyze the impact of profit persistence, business risk, and the form of capital on the earning return coefficient. This research attempted to quote inferior information from the Indonesian Stock Exchange for the 2014-2020 period. The population in this research is the industrial zone listed on the Indonesian Stock Exchange throughout the 2016-2020 period. The research population is 56 industries. The sample collection method used was purposive sampling. The research sample consisted of 40 industries. The analysis used in this research uses multiple linear regression using SPSS. The research results prove that profit persistence and business risk have no effect on ERC, on the contrary, DER has an effect on ERC. The GCG variable weakens the relationship between profit persistence and business risk on ERC, but GCG strengthens the influence of DER on ERC.

References

Anjani, L. P. A., & Yadnya, I. P. (2017). Pengaruh Good Corporate Governance Terhadap Profitabilitas Pada Pperusahaan Perbankan yang Terdaftar di BEI. 6(11), 5911–5940.

Agnes Sawir, 2009. Analisa Kinerja Keuangan dan Perencanaan keauangan Perusahaan, Jakarta: PT. Gramedia Pustaka Utama

Assagaf, A., & Murwaningsari, E. (2019). Estimates Model of Factors Affecting Financial Distress: Evidence from Indonesian State-owned Enterprises. Asian Journal of Economics, Business and Accounting.

Brigham, E. F., & Houston, J. F. (2014). Dasar-Dasar Manajemen Keuangan: Assetials Of Financial Management. In Salemba Empat.

Collins, D. W., & Kothari, S. P. (1989). An Analysis of Intertemporal and Cross-Sectional Determinants of Earnings Response Coefficients. Journal of Accounting and Economic, 11, 143–181.

Easton, P., & Zmijewski, M. (1989). Cross-Sectional Variation in the Stock Market Response to the Announcement of Accounting Earnings. Journal of Accounting and Economics, 11, 117–142.

Fitri, L. (2013). Pengaruh Ukuran Perusahaan, Kesempatan Bertumbuh dan Profitabilitas Terhadap Earnings Response Coefficient (Studi Empiris Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia (BEI) Tahun 2008-2011). Universitas Negeri Padang. https://doi.org/10.3109/14767058.2015.1135123

Kasmir. (2016). Analisis Laporan Keuangan. Raja Grafindo Persada.

Lipe, R., ‘The Relation Between Stock Returns and Accounting Earnings Given Alternative Information,’ The Accounting Review, Vol.65, No.1, Jan. 1990.

Mahendra, I. P. Y., & Wirama, D. G. (2017). Pengaruh Profitabilitas, Struktur Modal, Danukuran Perusahaan Pada Earnngs Response Coefficient. Jurnal Akuntansi, 20.

Nasution, M., & Setiawan, D. (2007). Pengaruh Corporate Governance Terhadap Manajemen Laba di Industri Perbankan Indonesia. SNA X Makasar.

Natalia, D., & Ratnadi, N. M. D. (2017). Pengaruh Konservatisme Akuntansi Dan Leverage Pada Earnings Response Coefficient. Jurnal Akuntansi, 20.

Natsir, R. S. El. (2018). Pengaruh Leverage Dan Persistensi Laba Terhadap Earnings Response Coefficient (Studi Empiris pada Perusahaan Sektor Properti dan Real Estate yang Terdaftar di Bursa Efek Indonesia 2012-2016). Jurnal Akuntansi.

Riyanto, B. (2010). Dasar-dasar pembelanjaan Perusahaan, Edisi Keempat. Yogyakarta: BPFE.

Sandi, K. U. (2013). Faktor-faktor yang mempengeruhi Earning Response Coefficient. 2(AAJ).

Scott, W. R. (2015). Financial Accounting Theory 7th Edition. In Financial Accounting Theory.

Sujarweni, V.W. 2017. Analisa Laporan Keuangan: Teori, Aplikasi, dan Hasil Penelitian. Pustaka Baru Press: Yogyakarta

Silalahi, S. P. (2014). Pengaruh Corporate Social Responsibility (CSR) Disclosure, Beta dan Price to Book Value (PBV) Terhadap Earnings Response Coefficient (ERC). Jurnal Ekonomi.

Sudarmaji, E., & Ambarwati, S. (2018). Fostering Nascent Entrepreneur: Unified Theory Of Acceptance And Use Of Technology And Entrepreneur Potential Model Within Higher Student’s Intention. Sci.Int.(Lahore), 30(30-(2)), 271–278.

Tandelilin, E. (2010). Portofolio dan Investasi Teori dan Aplikasi (pertama). Kanisius.

Tunggal, A. Wijaya. 2013. Internal Audit dan Good Corporate Governance. Jakarta: Erlangga.

Wicaksono, G. S., A. C. (2015). Mekanisme Corporate Governance Dan Kemungkinan Kecurangan Dalam Pelaporan Keuangan. Diponegoro Journal of Accounting, 4, 1–12.

Wijaya, H., Adhitya, S., Cahyadi, H., & Salim, S. (2020). Factors Affecting Earning Response Coefficient With Profitability as Moderating Variable in Manufacturing Companies. International Conference of Entrepreneurship and Business Management Untar.

Wijayanti, H. T. (2006). Analisis Pengaruh Perbedaan Antara Laba Akuntansi Dan Laba Fiskal Terhadap Persistensi laba, Akrual, dan Arus Kas. Simposium Nasional Akuntansi IX, Padan. Manajemen Laba dan Persistensi Laba. Simposium Nasional Akuntansi XII.

Suhardjo, S., Renaldo, N., Sevendy, T., Yladbla, D., Udab, R. N., & Ukanahseil, N. (2023). Accounting Skills, Digital Literacy, and Human Literacy on Work Readiness of Prospective Accountants in Digital Technology Disruption Era. Reflection: Education and Pedagogical Insights, 1(3), 106–115. http://firstcierapublisher.com/index.php/reflection/article/view/48