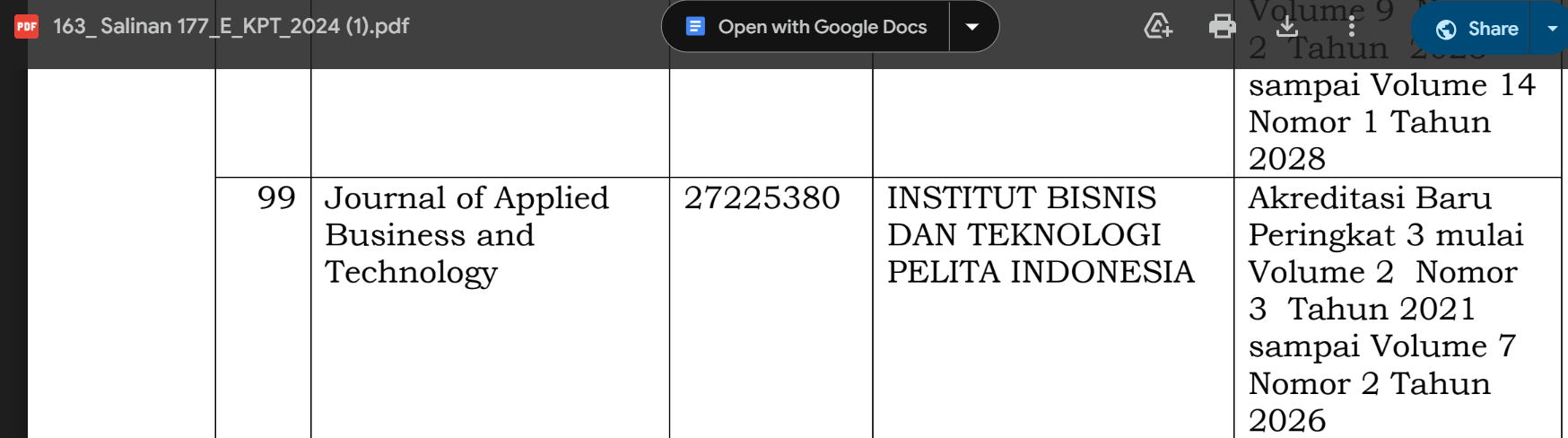

Mapping the Financial Technology Industry in Indonesia

DOI:

https://doi.org/10.35145/jabt.v5i1.162Keywords:

Industry, Financial, Technology, Financial Technology, IndonesiaAbstract

This study aims to deepen the fintech landscape in Indonesia with focus on types of fintech, companies popular, and the role of fintech market aggregators. With internet penetration reached 67%, Indonesia became lush backdrop for fintech innovation, supported by regulation and proactive government to support the growth sector This. Methodology study combine study literature, studies cases, interviews with holder interests, research field, analysis statistics, SWOT analysis, surveys users, and analysis continuity. The literature review provides a base for understanding global fintech trends, interim studies case detail development leading fintech companies like My Capital, Friends Money, and Kredivo. Research result covers identification four main types of fintech in Indonesia: P2P Lending and Crowdfunding, Management Risk Investment, Payment-Clearing-Settlement, and Market Aggregator. Fintech market aggregators such as Cekaja.com, Cermati.com, and DuitPintar.com play role important in give information and comparison product finance to consumer. With results study This is expected can give understanding deep about the evolution of fintech in Indonesia, as well give base for policy public, developers business, and internal investors optimizing growth and inclusion finance in the digital era.

References

Almulla, D., & Aljughaiman, A. A. (2021). Does financial technology matter? Evidence from an alternative banking system. Cogent Economics & Finance, 9(1), 1–21. https://doi.org/10.1080/23322039.2021.1934978

Amin, A. M., & Wijaya, J. (2024). Brand Trust, Celebrity Endorser, and Product Bundling on Purchasing Interest and Its Impact on Decisions to Purchase Starbucks Drink at Pekanbaru. Interconnection: An Economic Perspective Horizon, 1(4), 181–197. https://doi.org/https://doi.org/10.61230/interconnection.v1i4.69

Asif, M., Khan, M. N., Tiwari, S., Wani, S. K., & Alam, F. (2023). The Impact of Fintech and Digital Financial Services on Financial Inclusion in India. Journal of Risk and Financial Management, 16(122), 1–12. https://doi.org/10.3390/jrfm16020122

Bongmini, E. (2023). Analysis of the Accounting Information System for Purchases of Merchandise in an Effort to Improve Internal Control at PT. Riau Abdi Sentosa. Nexus Synergy: A Business Perspective, 1(3), 138–167. https://firstcierapublisher.com/index.php/nexus/article/view/56

Brown, E., & Piroska, D. (2022). Governing Fintech and Fintech as Governance: The Regulatory Sandbox, Riskwashing, and Disruptive Social Classification. New Political Economy, 27(1), 19–32. https://doi.org/10.1080/13563467.2021.1910645

Eddy, P., Sudarno, Renaldo, N., Hutahuruk, M. B., & Prayetno, M. P. (2023). The Effect of Farmers’ Exchange Rates on Rice Prices in 2017-2019. Luxury: Landscape of Business Administration, 1(2), 102–110. https://firstcierapublisher.com/index.php/luxury/article/view/33

Hossain, M., & Oparaocha, G. O. (2017). Crowdfunding: Motives, Definitions, Typology and Ethical Challenges. Entrepreneurship Research Journal, 7(2), 1–14. https://doi.org/10.1515/erj-2015-0045

Hutabarat, L. E. (2024). Analysis of the Internal Control System for Receivables at CV. Putra Riau Mandiri. Luxury: Landscape of Business Administration, 2(1), 1–25. https://doi.org/https://doi.org/10.61230/luxury.v2i1.65

Iman, N. (2020). The rise and rise of financial technology: The good, the bad, and the verdict. Cogent Business & Management, 7(1), 1–17. https://doi.org/10.1080/23311975.2020.1725309

Junaedi, A. T., Renaldo, N., Yovita, I., Veronica, K., & Jahrizal. (2023). Development of Digital Economy Teaching Materials: Basic Concepts of Business Intelligence. Reflection: Education and Pedagogical Insights, 1(2), 51–61. https://doi.org/10.61230/reflection.v1i2.28

Klimowicz, A., & Spirzewski, K. (2021). Concept of Peer-to-Peer Lending and Application of Machine Learning in Credit Scoring. In Journal of Banking and Financial Economics (Vol. 2, Issue 16). https://doi.org/10.7172/2353-6845.jbfe.2021.2.2

Kudri, W. M., & Putra, R. (2024). Elevating Village Financial Care: Igniting Excellence through Dynamic Education and Training in Work Motivation. Interconnection: An Economic Perspective Horizon, 1(4), 218–232. https://doi.org/https://doi.org/10.61230/interconnection.v1i4.73

Kumalasari, P. D., & Endiana, I. D. M. (2023). The Timeliness of Financial Reporting on Food and Beverage Companies in Indonesia. Nexus Synergy: A Business Perspective, 1(3), 193–198. https://firstcierapublisher.com/index.php/nexus/article/view/58

Kurniawan, Y., Putra, A. B. Y., & Cahyadewi, N. P. (2023). Get to Know P2P Lending and Investors Learning Process at Indonesia. Journal of System and Management Sciences, 13(1), 241–265. https://doi.org/10.33168/JSMS.2023.0114

Langley, P., & Leyshon, A. (2022). Neo-colonial credit: FinTech platforms in Africa. Journal of Cultural Economy, 15(4), 401–415. https://doi.org/10.1080/17530350.2022.2028652

Lusardi, A. (2019). Financial literacy and the need for financial education: evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1–8. https://doi.org/10.1186/s41937-019-0027-5

Mikalef, P., Krogstie, J., Pappas, I. O., & Pavlou, P. (2020). Exploring the relationship between big data analytics capability and competitive performance: The mediating roles of dynamic and operational capabilities. Information and Management, 57(2), 1–15. https://doi.org/10.1016/j.im.2019.05.004

Mufidah, A., Supeni, N., & Khsbullah, W. (2023). Strategies to Choose Financial Technology for Households. IConBEM, 249, 64–77. https://doi.org/10.2991/978-94-6463-216-3_6

Najib, M., Ermawati, W. J., Fahma, F., Endri, E., & Suhartanto, D. (2021). Fintech in the Small Food Business and Its Relation with Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 7(88), 1–17. https://doi.org/10.3390/joitmc7010088

Nyoto, Renaldo, N., & Effendi, I. (2023). SWOT Analysis of Economic Impact Development of Potential Kuantan Singingi Pacu Jalur Tourism Development. The Seybold Report, 18(02), 1342–1349. https://doi.org/10.17605/OSF.IO/T58CF

Pollio, A., & Cirolia, L. R. (2022). Fintech urbanism in the startup capital of Africa. Journal of Cultural Economy, 15(4), 508–523. https://doi.org/10.1080/17530350.2022.2058058

Renaldo, N., Jollyta, D., Suhardjo, Fransisca, L., & Rosyadi, M. (2022). Pengaruh Fungsi Sistem Intelijen Bisnis terhadap Manfaat Sistem Pendukung Keputusan dan Organisasi. Jurnal Informatika Kaputama, 6(3), 61–78.

Renaldo, N., Sudarno, S., Hutahuruk, M. B., Suyono, & Suhardjo. (2021). Internal Control System Analysis on Accounts Receivable in E-RN Trading Business. The Accounting Journal of Binaniaga, 6(2), 81–92. https://doi.org/10.33062/ajb.v5i2.382

Sekaran, U., & Bougie, R. (2016). Research Method for Business A Skill-Building Approach Seventh Edition (Seventh Ed). John Wiley & Sons. https://doi.org/10.1007/978-94-007-0753-5_102084

Setyowati, E., Zulaihati, S., & Fauzi, A. (2023). The Effect of Financial Literacy and Peers towards Saving Behavior with Self-Control as Mediating Variable of Undergraduate Students of Jakarta State University. Nexus Synergy: A Business Perspective, 1(1), 61–71. https://firstcierapublisher.com/index.php/nexus/article/view/40

Sevendy, T., Suhardjo, S., Renaldo, N., Remy, A., & Meyer, K. (2023). Internet Understanding Moderates the Influence of Technology Acceptance Model and Digital Taxation on Taxpayer Compliance. Interconnection: An Economic Perspective Horizon, 1(3), 163–170. http://firstcierapublisher.com/index.php/interconnection/article/view/53

Sudarno, Hutahuruk, M. B., Prayetno, M. P., Renaldo, N., Taylor, J. A., & Harrison, E. (2024). Educational Tactics through Social Marketing: Enhancing Awareness and Community Participation in Building a Quality Education Environment. Reflection: Education and Pedagogical Insights, 1(4), 203–215. https://doi.org/https://doi.org/10.61230/reflection.v1i4.64

Suhardjo, Renaldo, N., Sevendy, T., Yladbla, D., Udab, R. N., & Ukanahseil, N. (2023). Accounting Skills, Digital Literacy, and Human Literacy on Work Readiness of Prospective Accountants in Digital Technology Disruption Era. Reflection: Education and Pedagogical Insights, 1(3), 106–115. http://firstcierapublisher.com/index.php/reflection/article/view/48

Suhardjo, S., Renaldo, N., Sevendy, T., Wahid, N., & Cecilia, C. (2023). Customer Satisfaction with Online Food Delivery Services. Luxury: Landscape of Business Administration, 1(2), 90–101. https://firstcierapublisher.com/index.php/luxury/article/view/27

Suhardjo, S., Renaldo, N., Sevendy, T., Yladbla, D., Udab, R. N., & Ukanahseil, N. (2023). Accounting Skills, Digital Literacy, and Human Literacy on Work Readiness of Prospective Accountants in Digital Technology Disruption Era. Reflection: Education and Pedagogical Insights, 1(3), 106–115. http://firstcierapublisher.com/index.php/reflection/article/view/48

Suryono, R. R., Budi, I., & Purwandari, B. (2020). Challenges and Trends of Financial Technology (Fintech): A Systematic Literature Review. Information, 11(590), 1–20. https://doi.org/10.3390/info11120590

Suyono, Renaldo, N., Andi, Hocky, A., Suhardjo, Purnama, I., & Suharti. (2022). Training on the use of statistical software to improve teacher class action research performance at the Kerinci Citra Kasih Foundation. International Journal of Advanced Multidisciplinary Research and Studies, 2(4), 575–578.

Widyastuti, M., & Hermanto, Y. B. (2022). The effect of financial literacy and social media on micro capital through financial technology in the creative industry sector in East Java. Cogent Economics and Finance, 10(1), 1–15. https://doi.org/10.1080/23322039.2022.2087647