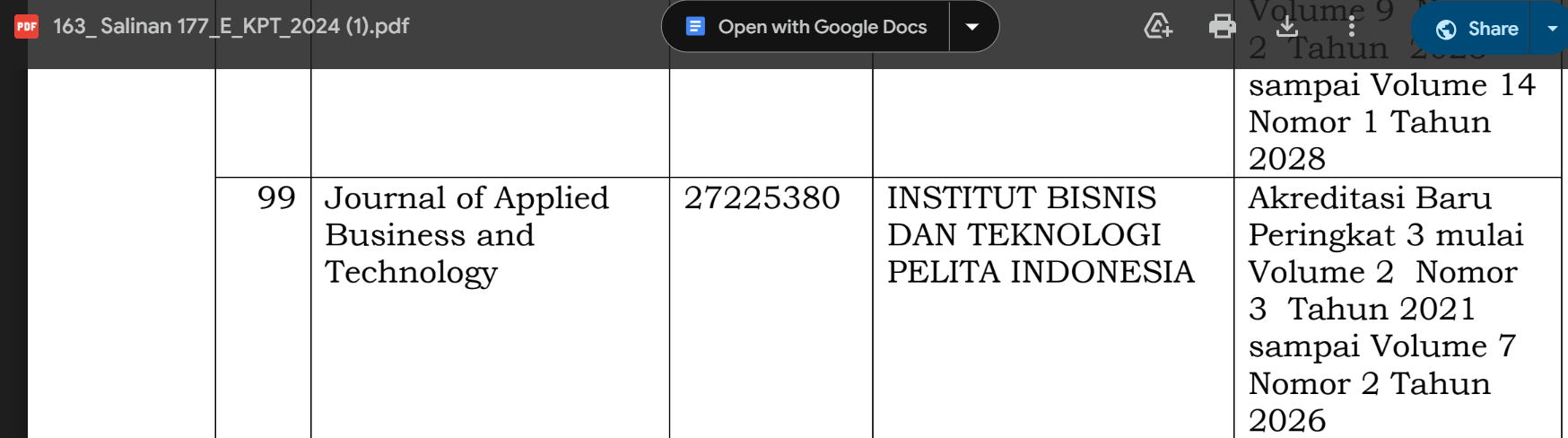

Impact of Stock Split on Stock Return in Companies Listed on the India Stock Exchange

DOI:

https://doi.org/10.35145/jabt.v5i3.163Keywords:

Stock Return, Stock Exchange, Stock Split, Stock PriceAbstract

The aim of this research is to evaluate the impact of a company's announcement, which in this case is a stock split, on the return of a company's stock listed on the Indian stock market. basing on this, the extent and significance of the effect is measured and examined through parametric and non-parametric tests. due to the aim of the paper is to test if the stock split will have a positive influence on the stock price around the implementation of the policy, we use the event study method and set regression model. In order to test the effect of the strategy, we picked estimation period and event period from each stock, and conduct regression analysis respectively. As suggested by the cumulative average AR value, the precision weighted CAAR and the ABHAR, the results imply that during the short window event of pre- and post-10 days of stock splits, the selected company have witnessed significant ARs so we reject H0 and accept H1, which suggests the presence of ARs within the event window. Similarly, other tests such as Patellz, Cross-sectional Test-t, Generalized Signz, Std. Cross-sectional Testz and Adjusted Patellz also suggest to reject H0 stating that there are ARs during the study window of the stocks splits. However, these findings are based on the 10-days event and 90-days estimation windows used for analysis and impact of the stocks splits on the stock returns of the selected company.

References

Alipour, M., Mohammadi, M. F. S., & Derakhshan, H. (2015). Determinants of capital structure: an empirical study of firms in Iran. International Journal of Law and Management, 57(1), 53-83. https://doi.org/10.1108/IJLMA-01-2013-0004

Ansorimal, Panjaitan, H. P., & Chandra, T. (2022). The Influence of the Work Creation Law Draft on Abnormal Return and Trading Volume Activity in LQ45 Share. Journal of Applied Business and Technology, 3(1), 17–25.

Anton, A., Lorensa, S., Purnama, I., Eddy, P., & Andi, A. (2023). Net Profit Margin, Earnings per Share, Return on Asset, Debt Equity Ratio, and Current Ratio on Firm Value in Agricultural Sector Companies Listed on Indonesia Stock Exchange 2016-2021. Journal of Applied Business and Technology, 4(2), 155–167. https://doi.org/10.35145/jabt.v4i2.131

Beladi, H., Chao, C. C., & Hu, M. (2016). Another January effect—Evidence from stock split announcements. International Review of Financial Analysis, 44, 123-138. https://doi.org/10.1016/j.irfa.2016.01.007

Brigham, F. Augene & Houston, F. Joel. (2015). Fundamentals of Corporate Finance, Cengage Learning.

Broyles, Jack. (2003). Financial Management and Real Options, British Library, John Wiley& Sons, U.S.A. ISBN: 978-0-470-85799-1

Chandra, T., Renaldo, N., & Putra, L. C. (2018). Stock Market Reaction towards SPECT Events using CAPM Adjusted Return. Opción, Año 34(Especial No.15), 338–374.

Datta, D., & Banerjee, P. (2012). Better Portfolio Diversification – A Neglected Aspect of Stock Splits: Findings from Indian Stock Market (SSRN Scholarly Paper No. 2148896). http://dx.doi.org/10.2139/ssrn.2148896

Fadrul, F., Howard, H., Nurazizah, F., Eddy, P., Novitriansyah, B., & Estu, A. Z. (2023). Analysis of Company Size, Inventory Intensity, and Variability of COGS on The Selection of Inventory Valuation Methods in Basic Materials Sector Companies Listed on IDX 2017-2021. Proceeding of International Conference on Business Management and Accounting (ICOBIMA), 2(1), 227–237. https://doi.org/https://doi.org/10.35145/icobima.v2i1.4068

Fadrul, F., Wijaya, F. T., Natalia, A., Estu, A. Z., Novitriansyah, B., & Hadi, S. (2024). The Effect of Profitability Ratio, Solvability Ratio, and Liquidity Ratio on Stock Price at Sector Company Consumer Non-Cyclicals Listed in Indonesia Stock Exchange Period 2017-2021. Proceeding of International Conference on Business Management and Accounting (ICOBIMA), 2(2), 317–331. https://doi.org/https://doi.org/10.35145/icobima.v2i2.4380

Fauzi, S. Z., Suhadak, S., & Hidayat, R. R. (2016). Pengaruh Pengumuman Stock split Terhadap Likuiditas Saham dan Return Saham (Studi Pada Perusahaan Yang Terdaftar Di Bursa Efek Indonesia Periode 2012-2014) (Doctoral dissertation, Brawijaya University).

Gilli, M., & Schumann, E. (2011). Risk–reward optimization for long-run investors: an empirical analysis. European Actuarial Journal, 1(2), 303–327. https://doi.org/10.1007/s13385-011-0024-2

Gitman, Lawrence J. (2009). Principles of Managerial Finance, 12th ed, Pearson, Prentice – Hall, New York.

Hocky, A., Pasaribu, Y. B., Junita, R., Putra, R., & Syahputra, H. (2023). The Effect of Price Earnings Ratio, Debt to Equity Ratio, Net Profit Margin, and Total Asset Turnover on Stock Returns on The Kompas 100 Index Agus. Proceeding of International Conference on Business Management and Accounting (ICOBIMA), 2(1), 271–281. https://doi.org/https://doi.org/10.35145/icobima.v2i1.4086

Hogg, R. (2022). Will Amazon stock split help the share price rebound? https://capital.com/amazon-stock-split2022-all-you-need-to-know.

How, C. C., & Tsen, W. H. (2019). The effects of stock split announcements on the stock returns in bursa Malaysia. Jurnal Ekonomi Malaysia, 53(2), 41–53. http://dx.doi.org/10.17576/JEM-2019-5302-4

Howells, Peter., Bain Keith. (2007). Financial markets& Institutions 3th ed prentice Hall 2007. ISBN: 0273709194, 9780273709190

Hutahuruk, M. B., Sudarno, S., Valencia, E., Angelina, D., & Priyono, P. (2024). Analysis of the Influence of CAR, LDR, NIM, BOPO, and NPL on Profitability in Conventional Banking Companies Listed on the IDX in 2017-2021. Proceeding of International Conference on Business Management and Accounting (ICOBIMA), 2(2), 332–347. https://doi.org/https://doi.org/10.35145/icobima.v2i2.4381

Ibrahim, D. C., & Panjaitan, H. P. (2020). Influence of NPM, PBV, DER, TATO, and EPS on Stock Prices of Automotive Sub Sector Companies and Its Components Listed on IDX in 2014-2018. Journal of Applied Business and Technology, 1(3), 151–162.

Infante, Y. O. T. A. Y., Arlyana, L., Haristan, M., & Akri, P. (2024). The Effect of Current Ratio, Debt To Equity Ratio, and Return on Assets on Dividend Policy Industrial Consumption Goods Sector Companies Listed in The Indonesian Stock Exchange Year 2013 – 2016. Proceeding of International Conference on Business Management and Accounting (ICOBIMA), 2(2), 391–401. https://doi.org/https://doi.org/10.35145/icobima.v2i2.4486

Kumalasari, P. D., & Endiana, I. D. M. (2023). Do Financial Performance Determine Firm Value? Evidence from Food and Beverage Companies in 2018-2021. Nexus Synergy: A Business Perspective, 1(1), 14–20. https://firstcierapublisher.com/index.php/nexus/article/view/9

Lasrya, E., Chandra, T., & Panjaitan, H. P. (2021). Determinants of Earnings Persistence with Capital Structure as Intervening Variable of Manufacturing Companies Listed on Indonesia Stock Exchange Period 2015-2019. Journal of Applied Business and Technology, 2(2), 98–108.

Lawrence J. Gitman, Chad J. Zutter, (2012), Principles of Managerial Finance, Fourteenth Edition, Prentice Hall.

Lin, J. C., Singh, A. K., & Yu, W. (2009). Stock splits, trading continuity, and the cost of equity capital. Journal of Financial Economics, 93(3), 474-489. https://doi.org/10.1016/j.jfineco.2008.09.008

Lumbantoruan, M. R., Panjaitan, H. P., & Chandra, T. (2021). The Influence of COVID-19 Events to Vaccination on Abnormal Return and Trading Volume Activity in IDX30 Companies. Journal of Applied Business and Technology, 2(3), 183–193.

Manik, S. R. M., Danisworo, D. S., Nurdin, A. A., & Barnas, B. (2023). Stock Return of Companies on the Indonesia Stock Exchange: A Comparative Study Before and After a Stock Split. Indonesian Journal of Economics and Management, 3(2), 313-321. https://doi.org/10.35313/ijem.v3i2.3798

Marwata. (2012). Financial Performance, Stock Price, And Stock Split. Journal of Indonesian Accounting Research. Vol. 4. pp 151-164.

Muna, H., & Khaddafi, M. (2022). The effect of stock split on stock return, stock trading volume, and systematic risk in companies listed on the Indonesia stock exchange. International Journal of Finance, Economics and Business, 1(1), 51-56. https://doi.org/10.56225/ijfeb.v1i1.4

Nguyen, V., Tran, A., & Zeckhauser, R. (2017). Stock splits to profit insider trading: Lessons from an emerging market. Journal of International Money and Finance, 74, 69-87. https://doi.org/10.1016/j.jimonfin.2017.02.028

Pandow, B. A., & Butt, K. A. (2019). Impact of share splits on stock returns: evidences from India. Vision, 23(4), 432-441. https://doi.org/10.1177/0972262919868130

Putra, I., & Suarjaya, A. A. G. (2020). Analysis of Market Reaction to Announcements of Stock Split. American Journal of Humanities and Social Sciences Research, 4(6), 114–120.

Riantani, S., & Hendayana, Y. (2020). The Measurement of Stock Performance on Stock Split and Reverse Stock. Solid State Technology, 63(3), 3552-3558.

Renaldo, N., Andi, Nur, N. M., Junaedi, A. T., & Panjaitan, H. P. (2021). Determinants of Firm Value for Wholesale Sub-sector Companies in 2016-2019 with Behavioral Accounting Approach. Journal of Applied Business and Technology, 2(1), 1–12. https://doi.org/https://doi.org/10.35145/jabt.v2i1.55

Renaldo, N., Fadrul, Andi, Sevendy, T., & Simatupang, H. (2022). The Role of Environmental Accounting in Improving Environmental Performance through CSR Disclosure. International Conference on Business Management and Accounting (ICOBIMA), 1(1), 17–23. https://doi.org/https://doi.org/10.35145/icobima.v1i1.2743

Renaldo, N., James, Alan, Wahid, N., & Cecilia. (2023). Underemployment Rate by Gender in 2015-2018. Interconnection: An Economic Perspective Horizon, 1(2), 100–104. https://doi.org/10.61230/interconnection.v1i2.38

Renaldo, N., Junaedi, A. T., Sudarno, Hutahuruk, M. B., Fransisca, L., & Cecilia. (2022). Social Accounting and Social Performance Measurement in Corporate Social Responsibility. International Conference on Business Management and Accounting (ICOBIMA), 1(1), 10–16. https://doi.org/https://doi.org/10.35145/icobima.v1i1.2742

Renaldo, N., Rozalia, D. K., Musa, S., Wahid, N., & Cecilia. (2023). Current Ratio, Firm Size, and Return on Equity on Price Earnings Ratio with Dividend Payout Ratio as a Moderation and Firm Characteristic as Control Variable on the MNC 36 Index Period 2017-2021. Journal of Applied Business and Technology, 4(3), 214–226. https://doi.org/10.35145/jabt.v4i3.136

Renaldo, N., Sally, Musa, S., Wahid, N., & Cecilia. (2023). Capital Structure, Profitability, and Block Holder Ownership on Dividend Policy using Free Cash Flow as Moderation Variable. Journal of Applied Business and Technology, 4(2), 168–180. https://doi.org/https://doi.org/10.35145/jabt.v4i2.132

Renaldo, N., Sudarno, Hutahuruk, M. B., Junaedi, A. T., Andi, & Suhardjo. (2021). The Effect of Entrepreneurship Characteristics, Business Capital, and Technological Sophistication on MSME Performance. Journal of Applied Business and Technology, 2(2), 109–117. https://doi.org/https://doi.org/10.35145/jabt.v2i2.74

Renaldo, N., Sudarno, S., Hughes, A., Smith, H., & Schmidt, M. (2024). Unearthed Treasures by Unlocking the Secrets of Forgotten Cash through Dynamic Cash Flow Analysis. Luxury: Landscape of Business Administration, 2(1), 85–92. https://doi.org/10.61230/luxury.v2i1.75

Renaldo, N., Suhardjo, Andi, Sevendy, T., & Purnama, I. (2023). Improving Accounting Students’ Statistical Understanding of 2-Way ANOVA Through a Case Study of Indonesian Coffee Exports. Reflection: Education and Pedagogical Insights, 1(1), 13–19. https://firstcierapublisher.com/index.php/reflection/article/view/4

Renaldo, N., Suhardjo, Suyono, Andi, Veronica, K., & David, R. (2022). Good Corporate Governance Moderates the Effect of Environmental Performance and Social Performance on Financial Performance. International Conference on Business Management and Accounting (ICOBIMA), 1(1), 1–9. https://doi.org/https://doi.org/10.35145/icobima.v1i1.2741

Renaldo, N., Suyono, Andi, Putri, N. Y., & Cecilia. (2023). How Business Intelligence, Intellectual Capital, and Company Performance Increase Company Value? Leverage as Moderation. Journal of Applied Business and Technology, 4(1), 93–99. https://doi.org/https://doi.org/10.35145/jabt.v4i1.123

Ross, Stephen A. Westerfield, Randolph W. & Jordan, Bradford D. (2010). Fundamentals of Corporate Finance. 9th ed, McGraw- Hill, Irwin.

Rukmana, R. (2020). Pengaruh kinerja keuangan terhadap harga saham Pada perusahaan sub sektor farmasi yang terdaftar di Bursa Efek Indonesia tahun 2009-2018 [Diploma, UIN Sunan Gunung Djati Bandung.

Sari, Chandra, T., & Panjaitan, H. P. (2021). The Effect of Company Size and DER on ROA and Company Value in the Food and Beverage Sub Sector on the Indonesia Stock Exchange (IDX). Journal of Applied Business and Technology, 2(2), 134–141.

Satyajit, D., & Sweta, C. (2008). Market Reaction around the Stock Splits and Bonus Issues: Some Indian Evidence. http://dx.doi.org/10.2139/ssrn.1087200

Scott, David Logan. (2005). David Scott's Guide to Investing in Common Stocks, Houghton Miff in Company, Boston.

Sheeba, Kapil. (2011). Financial Management, Dorling Kindersley Pvt. Ltd, India.

Stevany, Wati, Y., Chandra, T., & Wijaya, E. (2022). Analysis of the Influence Events on the Increase and Decrease of World Oil Prices on Abnormal Return and Trading Volume Activity in Mining Sector Companies that Registered in Indonesia Stick Exchange. International Conference on Business Management and Accounting (ICOBIMA), 1(1), 181–192.

Suharti, S., & Murwaningsari, E. (2024). The Effect of Profit Persistency, Business Risk and Capital Structure on Earnings Return Coefficient with Good Corporate Governance as Moderating Variable. Journal of Applied Business and Technology, 5(1), 1–7. https://doi.org/https://doi.org/10.35145/jabt.v5i1.158

Susmita, Sari. (2023). Analysis of the Effect of Stock Split and Capital Structure on Stock Liquidity in Manufacturing Companies Listed on the Indonesia Stock Exchange (IDX) 2018-2020 PERIOD. MANKEU (JURNAL MANAJEMEN KEUANGAN), 1(1), 13-27. https://doi.org/10.61167/mnk.v1i1.4

Titman, Sheridan Keown, Arthur J. & Martin, John D. (2011). Financial Management Principles and Applications, 12th ed, Pearson, Prentice Hall.

Vina, J., Junaedi, A. T., & Panjaitan, H. P. (2021). Determinants of Profitability and Capital Structure in KOMPAS100 Index Companies Year 2016-2020. Journal of Applied Business and Technology, 2(3), 233–242.

Wijaya, E., Ali, Z., Hocky, A., Anton, A., & Oliver, W. (2023). Impact of Company Size, Income on Share, Debt to Equity, Total Assets Revenue and Net Profit on The Kompas 100 Company Value Index. Proceeding of International Conference on Business Management and Accounting (ICOBIMA), 2(1), 218–226. https://doi.org/https://doi.org/10.35145/icobima.v2i1.4066

Xinyu Ge, Lin Li and Han Leng. (2023). The Impact of Stock Splits on Stock Prices, Proceedings of the 2023 International Conference on Management Research and Economic Development https://doi.org/10.54254/2754-1169/18/20230054.

Zhu, T. T. (2015). Capital structure in Europe: determinants, market timing and speed of adjustment (Doctoral dissertation, University of Leicester).