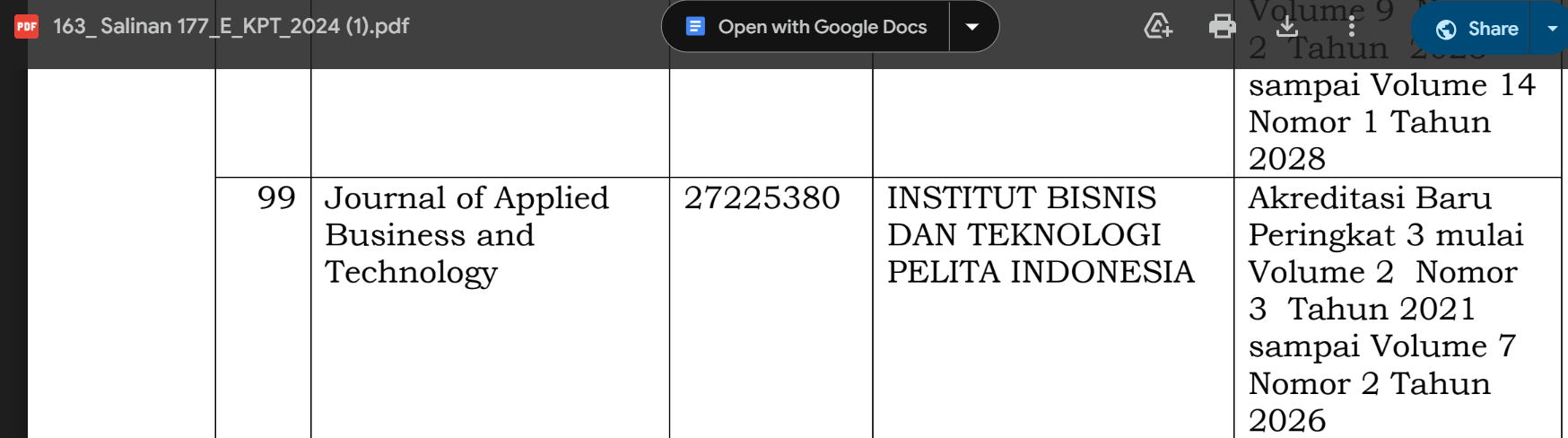

Analysis of the Effect of Solvability Ratio, Profitability, and Market Ratio on Share Prices of Pharmaceutical Sub Sector Companies Listed on Indonesia Stock Exchange (IDX) Period 2014-2018

DOI:

https://doi.org/10.35145/jabt.v1i2.39Keywords:

Earnings per Share, Debt to Equity Ratio, Return on Assets, Price Earnings RatioAbstract

This research aims to determine the effects of financial ratios to share prices in pharmaceutical sector companies in Indonesia. The dependent variable used was Share Prices, while the independent variable included EPS, DER, ROA and PER. The samples taken were the companies listed on the pharmaceutical sector of Indonesia Stock Exchange which were selected using purposive sampling. Among 12 companies listed on the pharmaceutical sector in the population, 3 companies have not published financial reports. Hence, the samples used in this research were only 9 companies. The method used was linear regression. The result showed that, earnings per share have positive influence to the share prices, debt to equity ratio have have negative influence to the share prices, return on assets have positive influence to the share prices and price earnings ratio have positive influence to the share prices.

References

Brigham, Eugene F. Dan J.F. Houston. 2010. Dasar-Dasar Manajemen Keuangan. Edisi 11. Jakarta: Salemba Empat.

Çekrezi, A. (2013). Impact Of Firm Specific Factors On Capital Structure Decision: An Empirical Study Of Albanian Firms. European Journal of Sustainable Development, 2(4), 135–148.

Dewi, P. D. A., & Suaryana. (2015). Pengaruh EPS, DER, Dan PBV Terhadap Harga Saham. 1, 215–229.

Diana, S. R. (2018). Analisis Laporan Keuangan dan Aplikasinya (Pertama; L. Hakim, L. Widia, Marsudin, & W. Pratiwi, eds.). IN MEDIA.

Egam, G. E. Y., Ilat, V., & Pangerapan, S. (2017). Pengaruh Return On Asset (ROA), Return On Equity (ROE), Net Profit Margin (NPM), dan Earning Per Share (EPS) terhadap Harga Saham Perusahaan yang tergabung dalam LQ45 di bursa efek indonesia periode tahun 2013 - 2015. Jurnal EMBA, Vol 5(No. 1), 105–114.

Fahmi, I. (2018). Pengantar Manajemen Keuangan (Keenam; M. A. Djalil, ed.). ALFABETA,cv.

Gujarati, D. N., & C.Porter, D. (2009). Essentials of Econometric. https://doi.org/10.1177/014662168400800314

Hanafi, M. M., & Halim, A. (2018). Analisis Laporan Keuangan (Kelima). UPP STIM YKPN.

Law Ren Sia, V., & Tjun Tjun, L. (2011). Pengaruh Current Ratio, Earnings Per Share, dan Price Earnings Ratio Terhadap Harga Saham Perusahaan LQ45 Periode 2006 - 2009. Akuntansi, 3(2), 136–158.

Nurfadillah, M. (2011). Analisis Pengaruh Earning Per Share, Debt To Equity Ratio dan Return On Equity Terhadap Harga Saham PT Unilever Indonesia Tbk. 12(April), 45–50.

Oca Viandita, T., Suhadak, & Husaini, A. (2013). Pengaruh Debt Ratio ( DR ), Price To Earning Ratio ( PER ), Earning Per Share ( EPS ), Dan Size Terhadap Harga Saham (Studi pada Perusahaan Industri yang Terdaftar di Bursa Efek Indonesia). Jurnal Administrasi Bisnis, 1(2), 113–121. https://doi.org/10.9744/jmk.5.2.pp. 171-180

Pratama, A., & Erawati, T. (2014). Pengaruh Current Ratio, Debt To Equity Ratio,Return On Equity, Net Profit Margin Dan Earning Per Share Terhadap Harga Saham (Study Kasus Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia Periode 2008-2011). Jurnal Akuntansi, 2(1), 1–10. Retrieved from https://jurnalfe.ustjogja.ac.id/index.php/akuntansi/article/view/20

Putri, J. (2014). Analisis faktor fundamental, economic value added (EVA) dan volume perdagangan terhadap harga saham di Jakarta Islamic index (JII) tahun 2008-2012.

Ratih, D., Apriatni, E. P., & Saryadi. (2013). Pengaruh EPS, PER, DER, ROE Terhadap Harga Saham pada Perusahaan Sektor Pertambangan yang Terdaftar BEI tahun 2010-2012. 1–12.

Robinson, T. R., Greuning, H. van, Henry, E., & Broihahn, M. A. (2009). International Financial Statement Analysis.

Sartono, Agus. 2008. Manajeman Keuangan Teori dan Aplikasi. Edisi Keempat.

Yogyakarta : BPFEYogyakarta.

Sondakh, F., Tommy, P., & Mangantar, M. (2006). Current Ratio, Debt to Equity Ratio, Return on Assets, Return on Equity Pengaruhnya terhadap Harga Saham pada indeks LQ 45 di BEI periode 2010-2014. Encyclopedia of Production and Manufacturing Management, 3(2), 138–138. https://doi.org/10.1007/1-4020-0612-8_202

Sugiyono (2011). Metode Penelitian Kuantitatif Kualitatif DAN R&D (cetakan ke- 14). Bandung: Alfabeta.

Sunariyah. (2004). Pengantar Pengetahuan Pasar Modal. Edisi Kelima. Bandung: CV Alfabeta

Susilawati, C. D. K. (2012). Analisis Perbandingan Pengaruh Likuiditas, Solvabilitas, Dan Profitabilitas Terhadap Harga Saham Pada Perusahaan LQ 45. Jurnal Akuntansi Maranatha, 4(2), 165–174.

www.finance.yahoo.com

www.idx.co.id

www.sahamok.com