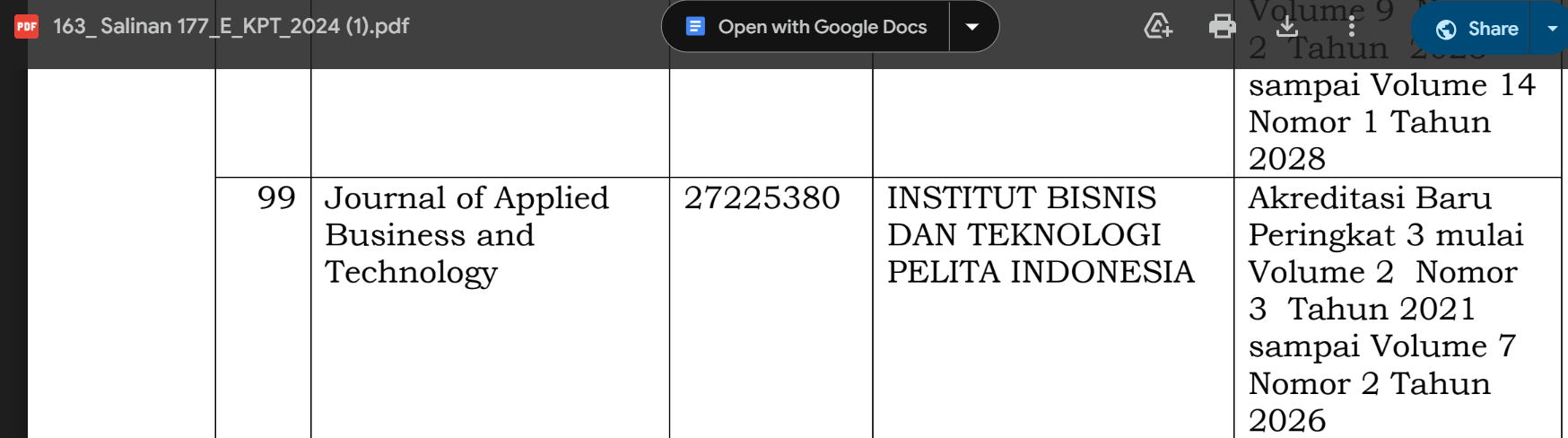

Capital Structure and Profitability of LQ45 Index in Indonesia : Pecking Order Theory Approach

DOI:

https://doi.org/10.35145/jabt.v1i2.32Keywords:

Tangibility, Growth, Firm Size, Capital Structure, ProfitabilityAbstract

Capital structure and profitability are part of company's financial system. Capital structure leads to company funding by utilizing long-term debt, preferred stock, and shareholder capital, while profitability refers to company's ability to generate profits. This study aims to analyze the effect of tangibility, growth, and company size on capital structure and profitability on LQ45 index. Sampling was carried out by purposive sampling technique and obtained 38 companies. Smart PLS program was utilized to assist research data analysis process. Results indicated that reliability, growth and company size had a significant effect on capital structure but they did not have a significant effect on profitability. Additionally, capital structure had a significant negative effect on profitability. The research results support pecking order theory which believes that the lower the company's debt, the higher the company's profitability.

References

Al Ani, M., & Al Amri, M. (2015). The Determinants of Capital Structure: an Empirical Study of Omani Listed Industrial Companies. Verslas: Teorija Ir Praktika, 16(2), 159–167. https://doi.org/10.3846/btp.2015.471

Alipour, M., Mohammadi, M. F. S., & Derakhshan, H. (2015). Determinants of Capital Structure: An Empirical Study of Firms in Iran. International Journal of Law and Management, 57(1), 53–83. https://doi.org/10.1108/IJLMA-01-2013-0004

Chadha, S., & Sharma, A. K. (2015). Capital Structure and Firm Performance?: Empirical Evidence from India. Vision, 19(4), 295–302. https://doi.org/10.1177/0972262915610852

Chandra, T. (2015). The Determinants of the Capital Structure: Empirical Evidence from Indonesian Stock Exchange Companies. Revista Kasmera, 43(2), 76–87.

Chandra, T., Junaedi, A. T., Wijaya, E., Chandra, S., & Priyono. (2019). The Co-Determinant of Capital Structure and Profitability Based on the Supply Chain Strategy: Evidence from Manufacturing Sector in Indonesia. International Journal of Supply Chain Management, 8(6), 705–717.

Chen, L. J., & Chen, S. Y. (2011). The Influence of Profitability on Firm Value with Capital Structure as the Mediator and Firm Size and Industry as Moderators. Investment Management and Financial Innovations, 8(3), 121–129. https://doi.org/10.1002/rhc3.12043

Dawar, V. (2014). Agency Theory , Capital Structure and Firm Performance?: Some Indian Evidence. Managerial Finance, 40(12), 1–19. https://doi.org/http://dx.doi.org/10.1108/MF-10-2013-0275

Fauzi, F., Basyith, A., & Idris, M. (2013). The Determinants of Capital Structure: An Empirical Study of New Zealand-Listed Firms. Asian Journal of Finance & Accounting, 5(2), 1. https://doi.org/10.5296/ajfa.v5i2.3740

Ghozali, I. dan H. L. (2012). Partial Least Square “Konsep, Teknik dan Aplikasi” Smart PLS 2.0 M3. Semarang: Universitas Diponegoro.

Indah, P., Sari, P., & Abundanti, N. (2011). Pengaruh Pertumbuhan Perusahaan dan Leverage terhadap Profitabilitas dan Nilai Perusahaan. Public Knowledge Project, 1427–1441.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the Firm?: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/http://dx.doi.org/10.1016/0304-405X(76)90026-X

Laz?r, S. (2016). Determinants of Firm Performance: Evidence from Romanian Listed Companies. Review of Economic and Business Studies, 9(1), 53–69. https://doi.org/10.1515/rebs-2016-0025

Lemma, T. T., & Negash, M. (2013). Institutional, Macroeconomic and Firm-Specific Determinants of Capital Structure: The African Evidence. In Management Research Review (Vol. 36). https://doi.org/10.1108/MRR-09-2012-0201

Miswanto, Abdullah, Y. R., & Suparti, S. (2017). Pengaruh Efisiensi Modal Kerja, Pertumbuhan Penjualan dan Ukuran Perusahaan terhadap Profitabilitas Perusahaan. Jurnal Bisnis dan Ekonomi, 24(2), 119-135.

Quang, D. X., & Xin, W. Z. (2014). The Impact of Ownership Structure and Capital Structure on Financial Performance of Vietnamese Firms. International Business Research, 7(2), 64–71. https://doi.org/10.5539/ibr.v7n2p64

Rifai, M., Arifati, R., & Magdalena, M. (2015). Pengaruh Ukuran Perusahaan, Struktur Modal Dan Pertumbuhan Perusahaan Terhadap Profitabilitas Studi Pada Perusahaan Manufaktur di BEI Tahun 2010-2012. Jurnal Ilmiah Mahasiswa Akuntansi, 1(1).

Riyanto, B. (2011). Dasar-Dasar Pembelanjaan Perusahaan. Yogyakarta: BPFE.

Salim, M., & Yadav, R. (2012). Capital Structure and Firm Performance: Evidence from Malaysian Listed Companies. Procedia - Social and Behavioral Sciences, 65(ICIBSoS), 156–166. https://doi.org/10.1016/j.sbspro.2012.11.105

Sawitri, N. P. Y. R., & Lestari, P. V. (2015). Pengaruh Risiko Bisnis, Ukuran Perusahaan dan Pertumbuhan Penjualan terhadap Struktur Modal. E-Jurnal Manajemen Unud, 4(5), 1238–1251.

Sheikh, N. A., & Wang, Z. (2011). Determinants of Capital Structure of Leasing Companies in Pakistan. Applied Financial Economics, 22(1), 1841-1853.

Swastika, R., & Isharijadi. (2017). Pengaruh Struktur Modal dan Pertumbuhan Perusahaan terhadap Profitabilitas. Forum Ilmiah Pendidikan Akuntansi, 5(1), 489–500.

Taghavi, M., Valahzaghard, M. K., & Alishahi, M. (2013). Co-Determination of Capital Structure and Stock Returns in Banking Industry Using Structural Equation Modeling. Management Science Letters, 3, 2367–2372. https://doi.org/10.5267/j.msl.2013.07.001

Titman, S., & Wessels, R. (1988). The Determinants of Capital Structure Choice. The Journal of Finance, 43(1), 1–19. https://doi.org/10.1111/j.1540-6261.1988.tb02585.x

Tse, C. B., & Rodgers, T. (2014). The Capital Structure of Chinese Listed Firms: Is Manufacturing Industry Special? Managerial Finance, 40(5), 469–486. https://doi.org/10.1108/MF-08-2013-0211

Wijaya, E., Asyik, N. F., Budiyanto, Chandra, T., & Priyono. (2020). Company’s Supply Chain Strategy in Internal Factors to Predict Capital Structure and Profitability on Manufacturing Sector. International Journal of Supply Chain Management, 9(1), 559–567.

Yang, C. C., Lee, C. few, Gu, Y. X., & Lee, Y. W. (2010). Co-Determination of Capital Structure and Stock Returns-A LISREL Approach. An Empirical Test of Taiwan Stock Markets. Quarterly Review of Economics and Finance, 50(2), 222–233. https://doi.org/10.1016/j.qref.2009.12.001

Yinusa, O. G., Somoye, R. O. C., Alimi, O. Y., & Muzliu-Ilo, B. (2015). Firm Performance and Capital Structure Choice of Firms?: Evidence from Nigeria. Journal of Knowledge Globalization, 9(1), 1–16. Retrieved from https://www.researchgate.net/publication/303613654_Firm_Performance_and_Capital_Structure_Choice_of_Firms_Evidence_from_Nigeria