How Business Intelligence, Intellectual Capital, and Company Performance Increase Company Value? Leverage as Moderation

DOI:

https://doi.org/10.35145/jabt.v4i1.123Keywords:

Business Intelligence, Intellectual Capital, Company Performance, Leverage, Company ValueAbstract

This study aims to analyze the role of leverage which moderates the effect of business intelligence, intellectual capital, and financial performance on firm value and is controlled by the variable firm size and sales growth in manufacturing industry companies on the IDX in 2013-2021. This study uses secondary data and panel data, a sample of 420 manufacturing industry companies in 2013-2021. The results of the first model study before moderation show that the independent variables of business intelligence, intellectual capital and company performance have a positive effect on firm value. However, for the leverage variable it has a negative effect on firm value, which shows that the higher the debt owned, the lower the company's value. The application of business intelligence can be done through the improvement of a good integrated system. Companies should optimize their intellectual capital. The use of debt to finance a company can increase the value of the company, this increase should be considered before making a decision by considering the risks that will arise and the cash flows that will be received.

References

Andriani, Budi and Jamaluddin, Mahfud. (2014). The Influence of Intellectual Capital Components to Financial Performance and Value of the Firm Registered In Indonesia Stock Exchange. Macrothink Institute, Research In Applied Economics. Vol.6, No.1

Davison, L. (2001). Measuring Competitive Intelligence Effectiveness: Insights From The Advertising Industry. Competitive Intelligence Review, Vol. 12, No. 4.

Ekowati, Serra., Rusmana, O and Mafudi. (2012). Pengaruh Modal Fisik, Modal Finansial, dan Modal Intelektual Terhadap Kinerja Perusahaan Pada Perusahaan Manufaktur di Bursa Efek Indonesia. Jurnal Universitas Jendral Soedirman

Firer, S., dan S. M. Williams. (2003). Intellectual Capital and Traditional Measures Of Corporate Performance, Journal Of Intellectual Capital, Vol.4, No.3

Firnanda (2016), Analisa Likuiditas, Profitabiloitas, Solvabilitas dan Perputaran Persediaan Terhadap Nilai Perusahaan. Jurnal Ilmu dan Riset Manajemen. Vol 5 No 2.

Graham, J.R; Harvey, C.R, dan Rajgopal, S. (2005). The Economic Implications Of Corporate Financial Reporting. Journal Of Accounting And Economics, 40, P: 3-73.

Gunny, K. (2005). What Are The Consequences Of Real Earnings Management. Working Paper. University Of Colorado.

Hansen, V dan Juniarti. (2014). Pengaruh family control, size, sales growth, dan leverage terhadap profitabilitas dan nilai perusahaan pada sektor perdagangan, jasa, dan investasi. business acounting review, vol.2, no.1.

Hasibuan dkk (2016), Pengaruh Leverage dan Profitabilitas Terhadap Nilai Perusahaan, Jurnal administrasi Bisnis (JAB), Vol 39 No.1.

Iranmad, Mohsen. (2014). The Effect of Intellectual Capital on Cost of Finance and Firm Value. International Journal of Academic Research in Accounting, Finance and Management Sciences Vol. 4, No.2, pp. 1–12.

Jacub. (2012). Pengaruh Intellectual Capital dan Pengungkapannya Terhadap Nilai Perusahaan. Jurnal Ilmiah Mahasiswa Akuntansi, Vol 1 No.4

Joshi, Nisarg A; Jay Desai dan Arti Trivedi. (2012). Valuing companies by discounted cash flows. Institute of Management & Research, Ahmedabad, Gujarat, India.

Junaedi, A. T., Renaldo, N., Sudarno, Hutahuruk, M. B., Panjaitan, H. P., Suharti, Mujiono, Suhardjo, Andi, Suyono, & Fransisca, L. (2023). Paradigma Akuntansi Baru (N. Renaldo, A. T. Junaedi, Sudarno, Mujiono, M. B. Hutahuruk, Suyono, & T. Sevendy (eds.)). PT. Literasi Nusantara Abadi Grup.

Meidawati, 2016 (Jurnal Ilmu dan Riset Akuntansi, Vol 5 No2.2016), Pengaruh Size, Growth, Profitabilitas, Struktur Modal, Kebijakan Deviden Terhadap Nilai Perusahaan,

Mondal, Amitava and Kumar, Santanu. (2012). Intellectual capital and financial performance of Indian banks. Journal of Intellectual Capital, Emerald Vol. 13 No. 4, 2012 pp. 515-530.

Mulyadi. (2003). Sistem Akuntansi, Salemba Empat. Jakarta.

Pirttimäki, V. (2007). Conceptual Analysis Of Intelijen Bisnis. Tampere University Of Technology. Finland.

Pulic, A. (2000). Intellectual Capital: Navigating the New Business Landscape. Macmillan Pres Ltd. London.

Putra, I Gede Cahyadi. (2012). Pengaruh Modal Intelektual Pada Nilai Perusahaan Yang Go Public Di BEI. Jurnal Ilmiah Akuntansi dan Humanika Jinah Vol.2 No.1.

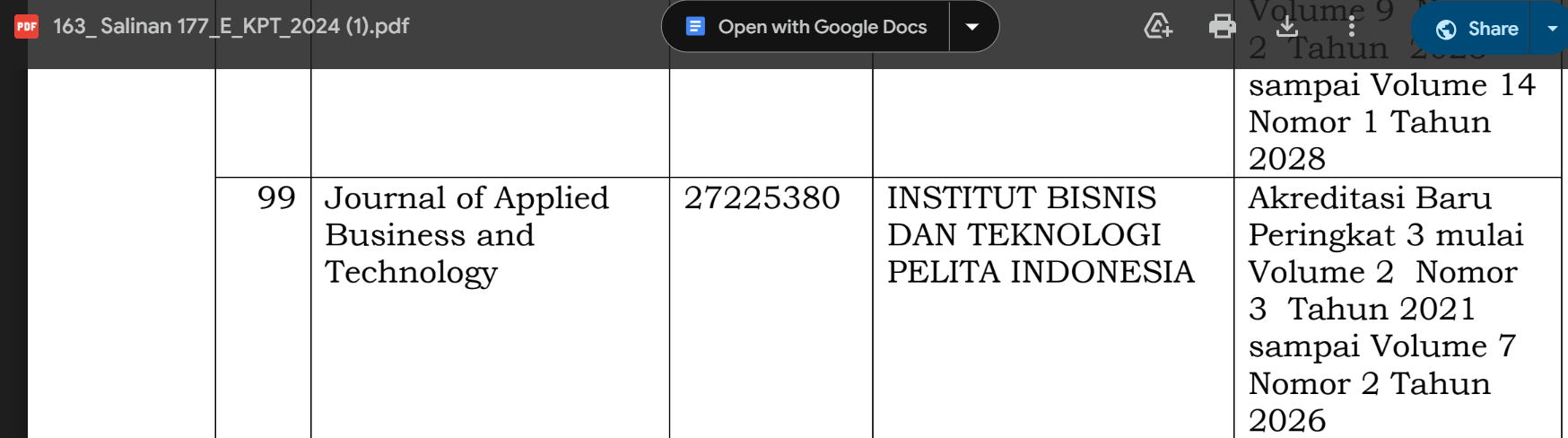

Renaldo, N., Andi, Nur, N. M., Junaedi, A. T., & Panjaitan, H. P. (2021). Determinants of Firm Value for Wholesale Sub-sector Companies in 2016-2019 with Behavioral Accounting Approach. Journal of Applied Business and Technology, 2(1), 1–12.

Renaldo, N., Fadrul, Andi, Sevendy, T., & Simatupang, H. (2022). The Role of Environmental Accounting in Improving Environmental Performance through CSR Disclosure. International Conference on Business Management and Accounting (ICOBIMA), 1(1), 17–23.

Renaldo, N., Jollyta, D., Suhardjo, Fransisca, L., & Rosyadi, M. (2022). Pengaruh Fungsi Sistem Intelijen Bisnis terhadap Manfaat Sistem Pendukung Keputusan dan Organisasi. Jurnal Informatika Kaputama, 6(3), 61–78.

Renaldo, N., Suhardjo, Putri, I. Y., Sevendy, T., & Juventia, J. (2021). Penilaian Harga Saham Berbasis Web pada Perusahaan Sektor Aneka Industri Tahun 2020. Kurs: Jurnal Akuntansi, Kewirausahaan Dan Bisnis, 6(1), 91–102. http://www.ejournal.pelitaindonesia.ac.id/ojs32/index.php/KURS/article/view/1309/711

Renaldo, N., Suhardjo, Suyono, Andi, Veronica, K., & David, R. (2022). Good Corporate Governance Moderates the Effect of Environmental Performance and Social Performance on Financial Performance. International Conference on Business Management and Accounting (ICOBIMA), 1(1), 1–9.

Saunders, David R. (1956), Moderator Variables in Prediction, Educational and Psychological Measurement, 16 (Summer), 209-22.

Sudarno, Putri, N. Y., Renaldo, N., Hutahuruk, M. B., & Cecilia. (2022). Leveraging Information Technology for Enhanced Information Quality and Managerial Performance. Journal of Applied Business and Technology, 3(1), 102–114.

Sudarno, Renaldo, N., Hutahuruk, M. B., Junaedi, A. T., & Suyono. (2022). Teori Penelitian Keuangan. In Andi (Ed.), Literasi Nusantara. CV. Literasi Nusantara Abadi.

Sudibya dan Restuti. (2014). Pengaruh Modal Intelektual terhadap Nilap Perusahaan Dengan Kinerja Keuangan Sebagai Variabel Intervening, Benefit Jurnal dan Bisnis, volume 18, Nomor 1, pp 14-29.

Sudiyatno, Bambang dan Puspitasari. (2010). Tobin’s q dan Altman z-score Sebagai Indikator Pengukuran Kinerja Perusahaan, Kajian Akuntansi, Hal. 9 – 21 Vol. 2. No. 19.

Sugiyono. (2011). Metode Penelitian Kuantitatif Kualitatif. Bandung: Alfabeta.

Suhardjo, Renaldo, N., Andi, Sudarno, Hutahuruk, M. B., Suharti, & Veronica, K. (2022). Bonus Compensation and Real Earnings Management: Audit Committee Effectiveness as Moderation Variable. The Accounting Journal of BINANIAGA, 07(01), 89–102. https://doi.org/10.33062/ajb.v7i1.495

Suhardjo, Renaldo, N., Suyono, Nyoto, & Ngatikoh, S. (2022). Determination of Profitability and Firm Value of the Food and Beverage Industry Sub Sector (Case study on the Food and Beverage Sub-sector Consumer Goods Industry on the IDX 2016-2020). Kurs: Jurnal Akuntansi, Kewirausahaan Dan Bisnis, 7(1), 105–115.

Trkman, P. Mccormack, K; Valadares De Oliveira, M. P, and Ladeiraa, M. B. (2010). The Impact Of Business Analytics On Supply Chain Performance. Decision Support System, 1-10.

Ulum, Ihyaul. (2008). “Intellectual Capital Performance Sektor Perbankan di Indonesia”. Jurnal Akuntansi dan Keuangan, Vol. 10, No. 2., 77-84.

Widhiastuti, Murwaningsari dan mayangsari (2018), the effect of Business Inteligence and Inellectual Capital of Company value moderated by Management of Profit Riil. SPI, Journal Of Accounting Businee and Finance Research, ISSN 2521-3830, Vol 2, No.2