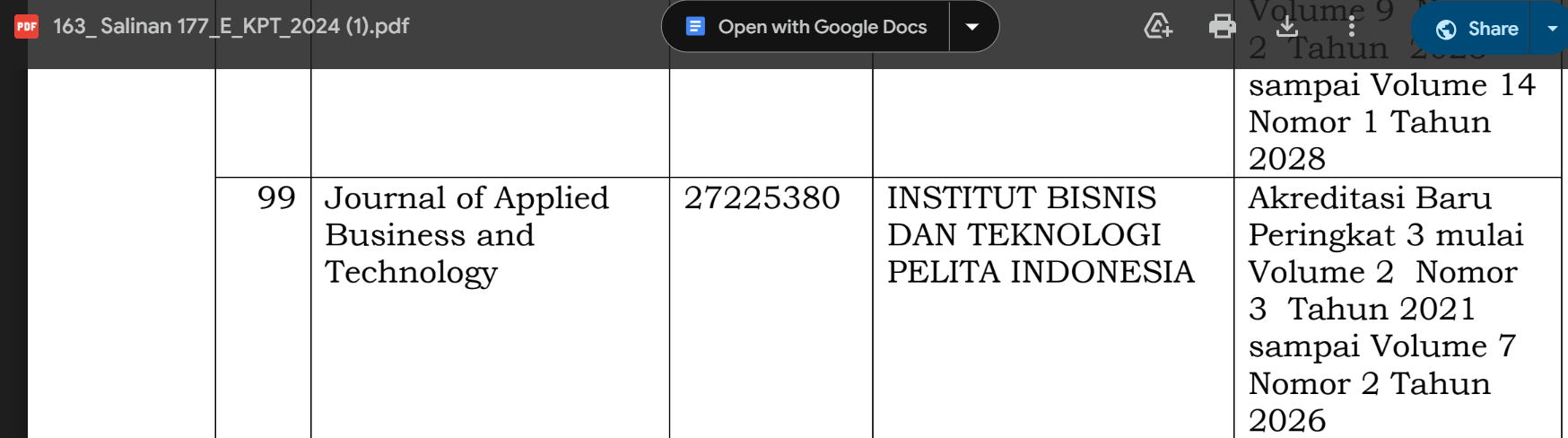

Current Ratio, Firm Size, and Return on Equity on Price Earnings Ratio with Dividend Payout Ratio as a Moderation and Firm Characteristic as Control Variable on the MNC 36 Index Period 2017-2021

DOI:

https://doi.org/10.35145/jabt.v4i3.136Keywords:

Price Earnings Ratio, Current Ratio, Company Size, Return on Equity, Dividend Payout RatioAbstract

This study aims to determine the effect of the Current Ratio, Company Size, Return on Equity, and Dividend Payout Ratio on the Price Earnings Ratio on the MNC36 index for the 2017-2021 period. The population and samples used in this study were to use the purposive sampling method which was selected based on specific criteria in accordance with the purpose of the study. Thus, the number of samples in this study was 77 companies. This study used secondary data. The analysis method in this study is multiple linear regression analysis using SPSS 22.0 and Smart PLS 4.0 software. The results of the research obtained are that DPR has a positive and significant effect on the Price Earnings Ratio. In contrast, the Current Ratio, Company Size, and Return on Equity do not have a significant effect on the Price Earnings Ratio.

References

Ain, Q. U., Yuan, X., Javaid, H. M., Zhao, J., & Xiang, L. (2021). Board Gender Diversity and Dividend Policy in Chinese Listed Firms. SAGE Open, 11(1), 1–19. https://doi.org/10.1177/2158244021997807

Andika, A., Chomsatu, Y., & Wijayanti, A. (2021). Jurnal Fair Value. Jurnal Ilmiah Akuntansi Dan Keuangan, 04(01), 1–12.

Anto, R. (2016). Faktor-Faktor Yang Mempengaruhi Price Earning Ratio (Per) Pada Indeks Lq 45 Di Bursa Efek Indonesia Periode 2012-2016. 15(2), 1–23.

Aprilia, E. P. (2012). Pengaruh return on equity (ROE), dividend payout ratio (DPR), earning per share (EPS), price earning ratio (PER) dan tingkat suku bunga terhadap harga saham (studi pada perusahaan manufaktur yang listing di bursa efek indonesia tahun 2009-2011). Jurnal Ilmiah Mahasiswa FEB, 1(2), 1–20.

Chandra, S., Okalesa, & Millenia, J. (2021). Pengaruh Firm Size, Growth Dan Advertising Terhadap Profitabilitas Dan Return Saham Perusahaan Subsektor Farmasi Di Bursa Efek Indonesia Tahun 2015-2019. 6(1), 8–23.

Chandra, T., Renaldo, N., & Putra, L. C. (2018). Stock Market Reaction towards SPECT Events using CAPM Adjusted Return. Opción, Año 34(Especial No.15), 338–374.

Dyah Sulistyawati, Poppy, M. (2016). Analisis Pengaruh Return On Equity, Debt To Equity Ratio, Dan Current Ratio Terhadap Price/Earning Ratio (Studi pada Perusahaan Consumer Goods yang Terdaftar di Bursa Efek Indonesia Periode 2012-2015). Diponegoro Journal of Management, 5(4), 1–12. http://ejournal-s1.undip.ac.id/index.php/dbr

Firdaus, I., & Ika, I. (2019). “Pengaruh Curent Ratio, Debt To Equity Ratio Dan Return On Assets Terhadap Price Earning Ratio (Studi Kasus pada Sub Sektor Konstruksi dan Bangunan yang Terdaftar di Bursa Efek Indonesia Tahun 2012 – 2017).” Jurnal Ilmiah Manajemen Bisnis, 5(2), 139–157. https://publikasi.mercubuana.ac.id/index.php/jimb/article/view/6832

Firmansyah, A., Suyono, Renaldo, N., Sevendy, T., & Stevany. (2022). Analisis Pengaruh Nilai Kurs Rupiah, Harga Emas Dunia, Harga Minyak Dunia, Current Ratio (CR), Return On Assets (ROA) dan Debt to Equity Ratio (DER) Terhadap Return Saham Perusahaan Sektor Pertambangan yang Terdaftar di Bursa Efek Indonesia. Procuratio: Jurnal Ilmiah Manajemen, 10(4), 400–413. http://ejournal.pelitaindonesia.ac.id/ojs32/index.php/PROCURATIO/index

Heryatno, R. (2019). Analisis Pengaruh Kepemilikan Institusional, Profitability Dan Firm Size Terhadap Price Earning Ratio (Per) Pada Perusahaan Lq-45 Periode 2011 – 2013. Jurnal Semarak, 2(1). https://doi.org/10.32493/smk.v2i1.2670

Imro’ah, N., Aprianto, A., & Naomi Nessyana Debataraja. (2020). Metode Cochrane-Orcutt Untuk Mengatasi Autokorelasi Pada Estimasi Parameter Ordinary Least Squares. Bimaster : Buletin Ilmiah Matematika, Statistika Dan Terapannya, 9(1), 95–102. https://doi.org/10.26418/bbimst.v9i1.38590

Isnaini, N. A., & Kurnia. (2017). Pengaruh Karakteristik Perusahaan terhadap Nilai Perusahaan: Corporate Social Responsibility sebagai variabel Intervening. Jurnal Ilmu Dan Riset Akuntansi, 6(2), 631–651.

Khan, B., Zhao, Q., Iqbal, A., Ullah, I., & Aziz, S. (2022). Internal Dynamics of Dividend Policy in East-Asia: A Comparative Study of Japan and South Korea. SAGE Open, 12(2), 1–11. https://doi.org/10.1177/21582440221095499

Khan, M. N., & Shamim, M. (2017). A sectoral analysis of dividend payment behavior: Evidence from Karachi Stock Exchange. SAGE Open, 7(1), 1–13. https://doi.org/10.1177/2158244016682291

Kustinah, S. (2019). Pengaruh Profitabilitas, Leverage Dan Kebijakan Dividen. Jurnal Ilmu Dan Riset Akuntansi, 8(11), 1–19.

Kusumawardhani, F. E. N., & Sapari. (2021). Pengaruh Rasio Pasar, Profitabilitas, Leverage, Dan Kebijakan Dividen Terhadap Return Saham. Jurnal Ilmu Dan Riset Akuntansi, 10(3), 1–20.

Lind, D. A., Marchal, W. G., & Wathen, S. A. (2018). Statistical Techniques in Business & Economics. Economics (Seventeenth). McGraw-Hill Education.

Mahmudah, U., & Suwitho. (2016). Pengaruh ROA, Firm Size dan NPM Terhadap Return Saham Pada Perusahaan Semen. Jurnal Ilmu Dan …, 5, 1–15. http://jurnalmahasiswa.stiesia.ac.id/index.php/jirm/article/download/396/402

Mandasari, P. (2016). Pengaruh Dpr, Der, Dan Roa Terhadap Per Pada Perusahaan Sektor Barang Konsumsi Yang Terdaftar Di Bei. Jurnal Profita Edisi 7 Tahun 2016, 2(1), 1–12.

Meirisa, Faradila, Wijaya, T. (2018). Pengaruh Current Ratio (CR), Debt To Equity Ratio (DER), Return On Equity (ROE) Terhadap Price Earning Ratio (PER) Pada Perusahaan Consumer Goods Yang Terdaftar Di Bursa Efek Indonesia Periode 2013-2017. STIE Multi Data Palembang, 8(1), 43–56.

Nyoto, Renaldo, N., & Effendi, I. (2023). SWOT Analysis of Economic Impact Development of Potential Kuantan Singingi Pacu Jalur Tourism Development. The Seybold Report, 18(02), 1342–1349. https://doi.org/10.17605/OSF.IO/T58CF

Putri, I. Y., Renaldo, N., Andi, Fransisca, L., Suhardjo, Suyono, & Erwin. (2022). Sustainability Report Disclosure and Profitability as a Strategy to Increase Future Firm Value in the Indonesian Banking Sector. International Journal of Advanced Multidisciplinary Research and Studies, 2(1), 100–104.

Rahmadewi, P. W., & Abundati, N. (2018). Pengaruh EPS, PER, CR, Dan ROE Terhadap Harga Saham. E-Jurnal Manajemen Unud, 7(4), 2106–2133.

Ravelita, N., Andini, R., & Santosa, E. B. (2018). Pengaruh Current Ratio , Debt To Equity Ratio , Return on Assets Terhadap Price Earning Ratio Melalui Price To Book Value Sebagai Variabel Intervening Pada Perusahaan Terdaftar Di Bursa Efek Indonesia Periode 2012-2016. Journal of Accounting, 1(1), 1–20.

Renaldo, N., & Murwaningsari, E. (2023). Does Gender Diversity Moderate the Determinant of Future Firm Value? Review of Economics and Finance, 21, 680–689. https://doi.org/https://doi.org/10.55365/1923.x2023.21.72

Renaldo, N., Putra, R., Suhardjo, Suyono, & Putri, I. Y. (2022). Strategi Menurunkan Turnover Intention Akuntan Pada Kantor Jasa Akuntansi Pekanbaru Tahun 2021. Jurnal Aplikasi Bisnis Dan Manajemen, 8(2), 588–600. https://doi.org/10.17358/jabm.8.2.588

Renaldo, N., Sudarno, Andi, Veronica, K., & Hutahuruk, M. B. (2023). Sales Volatility, Operating Cash Flow Volatility, Debt, and Firm Size on Future Earnings Persistence. The Accounting Journal of Binaniaga, 8(01), 27–38. https://doi.org/10.33062/ajb.v8i01.19

Renaldo, N., Sudarno, S., & Hutahuruk, M. B. (2020). Internal Control System Analysis on Accounts Receivable in SP Corporation. The Accounting Journal of Binaniaga, 5(2), 73. https://doi.org/10.33062/ajb.v5i2.382

Renaldo, N., Sudarno, S., Hutahuruk, M. B., Suyono, & Suhardjo. (2021). Internal Control System Analysis on Accounts Receivable in E-RN Trading Business. The Accounting Journal of Binaniaga, 6(2), 81–92. https://doi.org/10.33062/ajb.v5i2.382

Renaldo, N., Suhardjo, Putri, I. Y., Juventia, J., & Nur, N. M. (2021). Penilaian Harga Saham Hijau Perusahaan Sektor Industri Barang Konsumsi Tahun 2015-2019. Procuratio: Jurnal Ilmiah Manajemen, 9(3), 283–298.

Renaldo, N., Suhardjo, Putri, I. Y., Sevendy, T., & Juventia, J. (2021). Web-Based Share Price Assessment in Miscellaneous Industry Sector Companies Year 2020. Jurnal Akuntansi Dan Bisnis, 6(1), ISSN 2527-8223.

Renaldo, N., Suhardjo, Suyono, Putri, I. Y., & Cindy. (2022). Bagaimana Cara Meningkatkan Kinerja Lingkungan Menggunakan Green Accounting? Perspektif Generasi Z. Kurs: Jurnal Akuntansi, Kewirausahaan Dan Bisnis, 7(2), 134–144.

Renaldo, N., Suyono, Andi, Putri, N. Y., & Cecilia. (2023). How Business Intelligence, Intellectual Capital, and Company Performance Increase Company Value? Leverage as Moderation. Journal of Applied Business and Technology, 4(1), 93–99. https://doi.org/https://doi.org/10.35145/jabt.v4i1.123

Sanjaya, S., & Pratiwi, N. (2018). Pengaruh Tingkat Suku Bunga, Kurs Dan Inflasi Terhadap Jakarta Islamic Index (Jii) Sigit Sanjaya. Jurnal Ekonomi Dan Bisnis Islam, 3(1).

Sari, R. P., Hermuningsih, S., & Cahya, A. D. (2021). Pengaruh Current Ratio, Debt Equity Ratio, Total Asset Turnover Terhadap Price Earning Ratio. Jurnal Proaksi, 8(1), 156–165. https://doi.org/10.32534/jpk.v8i1.1706

Sekaran, U., & Bougie, R. (2016). Research Method for Business A Skill-Building Approach Seventh Edition (Seventh Ed). https://doi.org/10.1007/978-94-007-0753-5_102084

Sevendy, T., Renaldo, N., Nyoto, Sudarno, Suhardjo, Panjaitan, H. P., & Hutahuruk, M. B. (2023). Development of Tax Teaching Materials: Withholding Tax. Reflection: Education and Pedagogical Insights, 1(1), 20–27.

Sijabat, F. D., & Suarjaya, A. A. G. (2018). Ratio Pada Perusahaan Manufaktur Fakultas Ekonomi Universitas Udayana ( Unud ), Bali , Indonesia Abstrak Investasi adalah aktivitas penempatan dana yang dimiliki pada aset investasi dengan harapan memperoleh suatu keuntungan ( Ali , 2012 ). financial asse. Manajemen Unud, 7(7), 3681–3708.

Subair, F. (2013). Karakteristik Perusahaan Dan Industri Terhadap Pengungkapan dalam Laporan Keuangan Pada Perusahaan Manufaktur yang Go Publik. Jurnal EMBA, 1(3), 763–774.

Sudarno, Renaldo, N., Hutahuruk, M. B., Junaedi, A. T., & Suyono. (2022). Teori Penelitian Keuangan. In Andi (Ed.), Literasi Nusantara. CV. Literasi Nusantara Abadi.

Sudarno, Renaldo, N., Hutahuruk, M. B., Suhardjo, Suyono, Putri, I. Y., & Andi. (2022). Development of Green Trident Measurements to Improve Environmental Performance: Literature Study. International Journal of Advanced Multidisciplinary Research and Studies, 2(1), 53–57.

Suhardjo, S., Renaldo, N., Sevendy, T., Yladbla, D., Udab, R. N., & Ukanahseil, N. (2023). Accounting Skills, Digital Literacy, and Human Literacy on Work Readiness of Prospective Accountants in Digital Technology Disruption Era. Reflection: Education and Pedagogical Insights, 1(3), 106–115. http://firstcierapublisher.com/index.php/reflection/article/view/48

Suhardjo, Renaldo, N., Andi, Sudarno, Hutahuruk, M. B., Suharti, & Veronica, K. (2022). Bonus Compensation and Real Earnings Management: Audit Committee Effectiveness as Moderation Variable. The Accounting Journal of BINANIAGA, 07(01), 89–102. https://doi.org/10.33062/ajb.v7i1.495

Suhardjo, Renaldo, N., Sevendy, T., Rusgowanto, F. H., & Pramesti, I. G. A. A. (2023). Chi-Square and 2-Way ANOVA for Accounting Students: Analysis of Natural Gas Sales Volume by Pipeline by Customer Type in Indonesia. Reflection: Education and Pedagogical Insights, 1(1), 34–39.

Suyono, Renaldo, N., Sevendy, T., Putri, I. Y., & Sitompul, Y. S. (2021). Pengaruh ROA, DER terhadap Ukuran Perusahaan dan Nilai Perusahaan Makanan dan Minuman. Bilancia: Jurnal Ilmiah Akuntansi, 5(3), 308–317.

Suyono, Renaldo, N., Andi, Hocky, A., Suhardjo, Purnama, I., & Suharti. (2022). Training on the use of statistical software to improve teacher class action research performance at the Kerinci Citra Kasih Foundation. International Journal of Advanced Multidisciplinary Research and Studies, 2(4), 575–578.

Taruna, & Firdausy, C. M. (2016). Faktor-Faktor Yang Mempengaruhi Price Earning Ratio Saham Lq45 Di Indonesia. 15(2), 1–23.

Trenggonowati, D. L., & Kulsum. (2018). Analisis Faktor Optimalisasi Golden Age Anak Usia Dini Studi Kasus Di Kota Cilegon. 4(1), 48–56.

Utomo, W., Andini, R., & Raharjo, K. (2016). Pengaruh leverage (DER), price book value (PBV), ukuran perusahaan (Size), return on equity (ROE), dividend payout ratio (DPR) dan likuiditas (CR) terhadap price earning ratio (PER) pada perusahaan manufaktur yang listing di BEI tahun 2009-2014. Journal of Accounting, 2(2), 49–60.

Wahyuni, I., Susanto, A., & Asakdiyah, S. (2020). Pengaruh Debt To Equity Ratio (DER), CurrentRatio (CR), Return on Equity (ROE), dan Net Profit Margin (NPM) Terhadap Price Earning Ratio (PER) Perusahaan Sub Sektor Perkebunan yang Terdaftar pada Bursa Efek Indonesia Periode Tahun 2014-2017. Mbia, 19(1), 75–86. https://doi.org/10.33557/mbia.v19i1.863

Yusrizal, Renaldo, N., & Hasri, M. O. (2021). Pengaruh Good Governance dan Whistleblowing System terhadap Kepatuhan Wajib Pajak Orang Pribadi dengan Risiko Sanksi Pajak sebagai Moderasi di KPP Pratama Pekanbaru Tampan. Bilancia: Jurnal Ilmiah Akuntansi, 5(2), 119–134.