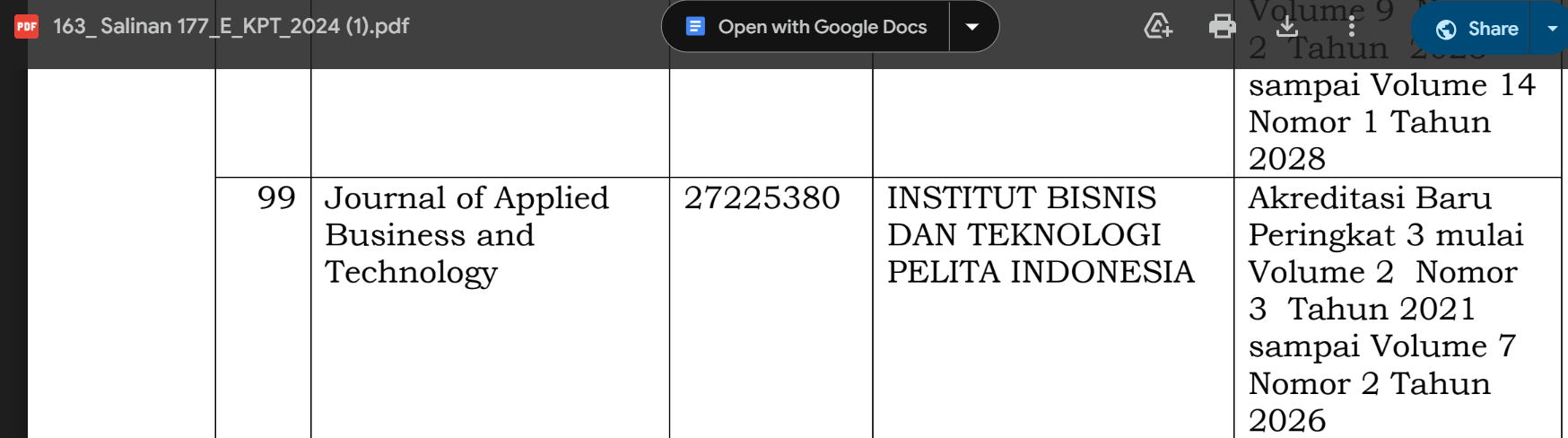

Capital Structure, Profitability, and Block Holder Ownership on Dividend Policy using Free Cash Flow as Moderation Variable

DOI:

https://doi.org/10.35145/jabt.v4i2.132Keywords:

Capital Structure, Profitability, Block Holder Ownership, Free Cash Flow, Dividend Payout RatioAbstract

The aim of this study is to investigate the influence of sales growth, company size, profitability, and non-debt tax shield on the capital structure of food and beverage companies in the consumer sector listed on the Indonesia Stock Exchange between 2017 and 2020. The research utilizes secondary data and employs purposive sampling to select a sample of 38 companies. Data analysis involves quantitative descriptive analysis and the use of SmartPLS software for various calculations. The findings indicate that block holder ownership does not significantly affect dividend policy, capital structure does not significantly impact dividend policy, profitability has a positive influence on dividend policy, and free cash flow does not significantly affect dividend policy. It is hoped that future researchers can add knowledge and insight in the field of financial and financing ratios and examine more deeply related to financial performance in the development of primary consumer goods sector companies on the IDX.

References

Arilaha, M. A. (2009). Pengaruh Free Cash Flow, Profitabilitas, Likuiditas dan Leverage Terhadap Kebijakan Dividen. Jurnal Keuangan Dan Perbankan, 13(1), 78–87.

Ariyani, V. (2008). Pengaruh Nilai Perusahaan terhadap Kepemilikan Blockholder : Perusahaan di BEI 2005-2008. Jurnal Manajemen Keuangan, 2(1), 1–11.

Asri, B., & Sofie, N. (2015). Pengaruh Struktur Modal Dan Likuiditas Terhadap Profitabilitas. Jurnal Akuntansi, 2(1), 13–28.

Bartholomeusz, S., & Tanewski, G. A. (2006). The Relationship Between Family Firms and Corporate Governance. Journal of Small Business Management.

Bhattacharya, S. (1997). Imperfect Information, Dividend Policy, and “the Bird in the Hand” Fallacy. CFA Digest, 27(1), 8–10. https://doi.org/10.2469/dig.v27.n1.3

Bostanci, F., Kadioglu, E., & Sayilgan, G. (2018). Determinants of dividend payout decisions: A dynamic panel data analysis of turkish stock market. International Journal of Financial Studies, 6(4). https://doi.org/10.3390/ijfs6040093

Brigham, E. F. (2006). Fundamental of financial management: Dasar-dasar manajemen keuangan (10th ed.). salemba empat.

Brigham, E. F., & Houston. (2006). Fundamental of Financial Management: Dasar-Dasar Manajemen Keuangan (10th ed.). salemba empat.

Brigham, E. F., & Houston, J. F. (2011). Dasar-dasar Manajemen Keuangan (10th ed.). salemba empat.

Claessens, S., Djankov, S., & H.P Lang, L. (1999). The Separation Ownership and Control in East Asian Corporations. Journal of Financial Economics, 58(1–2), 81–112.

Chandra, T., Renaldo, N., & Putra, L. C. (2018). Stock Market Reaction towards SPECT Events using CAPM Adjusted Return. Opción, Año 34(Especial No.15), 338–374.

Darsono, & asari. (n.d.). Pedoman Praktis Memahami Laporan Keuangan (Tips Bagi Investor, Direksi dan Pemegang Saham).

Djebali, R., & Belanès, A. (2015). On the impact of family versus institutional blockholders on dividend policy. Journal of Applied Business Research, 31(4), 1329–1342. https://doi.org/10.19030/jabr.v31i4.9320

Farinha, J., & Foronda, O. (2005). The Relation Between Dividends and Insider Ownership in Different Legal System: International Evidence. 1–35.

Fauziah, F. (2017). Kesehatan bank, Kebijakan dividen dan Nilai perusahaan teori dan kajian empiris. RV Pustaka Horizon.

Ghozali, I. (2015a). Aplikasi Analisis Multivariate dengan Program IBM SPSS.

Ghozali, I. (2015b). Aplikasi Analisis Multivariate dengan Program IBM SPSS. Semarang:

Herawati, F. (2017). Pengaruh Likuiditas, Leverage, Profitabilitas Invesment Opportunity Set Terhadap Dividend Payout Ratio. Jurnal Ilmu Dan Riset Ekonomi, 6(10), 2460–0585.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 76(2), 323–329. https://doi.org/10.1017/cbo9780511609435.005

Jensen, M. C., & Meckling, W. (1976). Theory of the firm: managerial behavior, agency cost and ownership structure. Journal of Finance Economic.

Jusriani, I. F. (2013). Analisis Profitabilitas, Kebijakan Dividen, Kebijakan Utang, Dan Kebijakan Manajerial Terhadap Nilai Perusaahaan [Universitas Diponegoro]. In Akuntansi. http://eprints.undip.ac.id/39008/

Kasmir. (2012). Analisis Laporan Keuangan. PT. Raja Grafindo Persada.

Khan, F. A., & Ahmad, N. (2017). Determinants of dividend payout: An empirical study of pharmaceutical companies of Pakistan stock exchange (PSE). Journal of Financial Studies & Research, 1–6. https://doi.org/10.5171/2017.538821

Kurniawan, & Ardeno. (2012). Audit Internal, Nilai Tambah bagi Organisasi. PBFE UGM.

Kusuma, P. J., Hartoyo, S., & Sasongko, H. (2018). Analysis of Factors that Influence Dividend Payout Ratio of Coal Companies in Indonesia Stock Exchange. Jurnal Dinamika Manajemen, 9(2), 189–197. https://doi.org/10.15294/jdm.v9i2.16417

Lestari, K. F., Tanuatmodjo, H., & Mayasari, M. (2017). Pengaruh Likuiditas Dan Profitabilitas Terhadap Kebijakan Dividen. Journal of Business Management Education (JBME), 2(1), 243–250. https://doi.org/10.17509/jbme.v4i1.2293

Lintner, J. (1956). Distribution of incomes of corporations among dividends, retained earnings, and taxes. The American Economic Review, 46(2), 97–113.

Lucyanda dan Lilyana. (2012). Jurnal Jurica Luciana. Pengaruh Free Cash Flow Dan Struktur Kempemilikan Terhadap Dividend Payout Ratio, 4(2), 129–138. https://doi.org/https://doi.org/10/15294/jda.v4i2.2171

Mardasari, R. B. (2014). Pengaruh Insider Ownership, Kebijakan Hutang Dan Free Cash Flow Terhadap Nilai Perusahaan Melalui Kebijakan Dividen. Jurnal Ilmu Manajemen, vol 2(nomor 4), hal 1807-1820.

Masdupi, E. (2012). Pengaruh Insider Ownership, Struktur Modal, Dan Pertumbuhan Perusahaan Terhadap Kebijakan Dividen Perusahaan. 12(1), 9–14. http://ejournal.unp.id/index.php/Economac/article/view/1274

Miller, M., & Modigliani, F. (1961). Dividend Policy, Growth, and The Valution of Shares. Journal of Business, 34(4), 411–433.

Nyoto, Renaldo, N., & Effendi, I. (2023). SWOT Analysis of Economic Impact Development of Potential Kuantan Singingi Pacu Jalur Tourism Development. The Seybold Report, 18(02), 1342–1349. https://doi.org/10.17605/OSF.IO/T58CF

Prihadi, T. (2012). Memahami Laporan Keuangan Sesuai IFRS dan PSAK. PPM.

Putri, I. Y., Renaldo, N., Andi, Fransisca, L., Suhardjo, Suyono, & Erwin. (2022). Sustainability Report Disclosure and Profitability as a Strategy to Increase Future Firm Value in the Indonesian Banking Sector. International Journal of Advanced Multidisciplinary Research and Studies, 2(1), 100–104.

Renaldo, N., & Murwaningsari, E. (2023). Does Gender Diversity Moderate the Determinant of Future Firm Value? Review of Economics and Finance, 21, 680–689. https://doi.org/https://doi.org/10.55365/1923.x2023.21.72

Renaldo, N., Suhardjo, Putri, I. Y., Juventia, J., & Nur, N. M. (2021). Penilaian Harga Saham Hijau Perusahaan Sektor Industri Barang Konsumsi Tahun 2015-2019. Procuratio: Jurnal Ilmiah Manajemen, 9(3), 283–298.

Santoso, R., Natalia, E., & Hoyyi, A. (2017). Analisis Kepuasan Masyarakat Terhadap Pelayanan Publik Menggunakan Pendekatan Partial Least Square (PLS) (Studi Kasus: Badan Arsip dan Perpustakaan Daerah Provinsi Jawa Tengah). Jurnal Gaussian, 6(3), 313–323.

Sudarno, Renaldo, N., Hutahuruk, M. B., Junaedi, A. T., & Suyono. (2022). Teori Penelitian Keuangan. In Andi (Ed.), Literasi Nusantara. CV. Literasi Nusantara Abadi.

Sudarno, Renaldo, N., Hutahuruk, M. B., Suhardjo, Suyono, Putri, I. Y., & Andi. (2022). Development of Green Trident Measurements to Improve Environmental Performance: Literature Study. International Journal of Advanced Multidisciplinary Research and Studies, 2(1), 53–57.

Sudarno, Renaldo, N., Veronica, K., Suhardjo, & Hutahuruk, M. B. (2022). Konsekuensi Manajemen Laba terhadap Relevansi Nilai di Indonesia. LUCRUM: Jurnal Bisnis Terapan, 2(2), 194–206.

Suhardjo, Renaldo, N., Andi, Sudarno, Hutahuruk, M. B., Suharti, & Veronica, K. (2022). Bonus Compensation and Real Earnings Management: Audit Committee Effectiveness as Moderation Variable. The Accounting Journal of BINANIAGA, 07(01), 89–102. https://doi.org/10.33062/ajb.v7i1.495

Suhardjo, Renaldo, N., Suyono, Nyoto, & Ngatikoh, S. (2022). Determinasi Profitability dan Firm Value Sub Sektor Industri Makanan dan Minuman (Studi kasus pada industri barang konsumsi subsektor makanan dan minuman di BEI 2016-2020). Kurs: Jurnal Akuntansi, Kewirausahaan Dan Bisnis, 7(1), 105–115.

Sutrisno. (2012). Manajemen Sumber Daya Manusia. Kencana.

Sutrisno, H. (2001). Metodolgi Research. Andi Yogyakarta.

Suyono, Renaldo, N., Sevendy, T., Putri, I. Y., & Sitompul, Y. S. (2021). Pengaruh ROA, DER terhadap Ukuran Perusahaan dan Nilai Perusahaan Makanan dan Minuman. Bilancia: Jurnal Ilmiah Akuntansi, 5(3), 308–317.

Suyono, Renaldo, N., Suhardjo, Sevendy, T., & Hia, E. R. (2022). Analisis Pengaruh DER dan CR terhadap ROA dan Harga Saham pada Perusahaan Manufaktur yang Terdaftar di BEI Periode 2015-2019. Bilancia: Jurnal Ilmiah Akuntansi, 6(2), 170–179. http://www.ejournal.pelitaindonesia.ac.id/ojs32/index.php/BILANCIA/index

Suyono, Renaldo, N., Andi, Hocky, A., Suhardjo, Purnama, I., & Suharti. (2022). Training on the use of statistical software to improve teacher class action research performance at the Kerinci Citra Kasih Foundation. International Journal of Advanced Multidisciplinary Research and Studies, 2(4), 575–578.

Thomsen, S., Pedersen, T., & Kvist, H. (2006). Blockholder ownership: Effect on firm value in market and control based governance systems. Journal of Corporate Finance, 246–269.