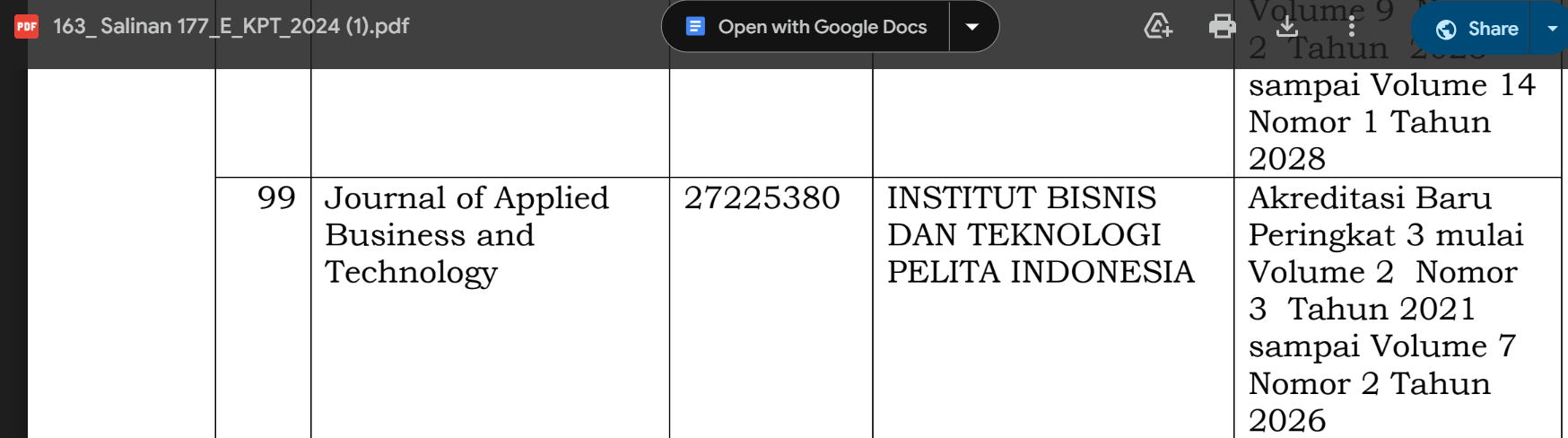

Is The Corporate Governance Important for Firm Value?

DOI:

https://doi.org/10.35145/jabt.v6i3.179Keywords:

Firm Value, Corporate Governance, Earning Management, Sales GrowthAbstract

This objective of this study is to examine the influence of Corporate Governance and Earning Management on the Firm Value with the moderating is Sales Growth. With cross-sectional data from 2023 from 227 cyclical and non-cyclical companies listed on the Indonesia Stock Exchange, and this study employs a quantitative methodology with the goal of analyzing. Data analysis uses Moderated Regression Analysis or MRA with Eviews 13.0 software to test the moderating effect of Sales Growth. With cross-sectional data from 2023 from 227 cyclical and non-cyclical companies listed on the Indonesia Stock Exchange, this study employs the quantitative methodology with the goal of analyzing The study's findings show that Earning Management (? = 0.414, p < 0.01) and Corporate Governance (? = 0.241, p < 0.01) significantly increase Firm Value. Sales Growth functions as a pure moderator, according to moderation analysis, while the link between Corporate Governance and Firm Value is more strongly moderated by the CG×SG interaction (? = 0.320, p < 0.05), and the association between Earning Management and Firm Value is moderated by the EM×SG interaction (? = -0.485, p < 0.01). Sales growth is a pure moderator that enhances the beneficial impact of corporate governance while diminishing the impact of the earnings management on firm value, according to this result.References

Albitar, K., Hussainey, K., Kolade, N., & Gerged, AM (2020). ESG disclosure and firm performance before and after IR: The moderating role of governance mechanisms. International Journal of Accounting and Information Management, 28(3), 429-444.

Amirrudin, M. Noor, I. H. M & Hassan, H (2021). The influence of corporate reputation on firm performance. Integrated reporting. Asian Journal of Business and Social Studies, 3(3), 22-37.

Ansorimal, Panjaitan, H. P., & Chandra, T. (2022). The Influence of the Work Creation Law Draft on Abnormal Return and Trading Volume Activity in LQ45 Share. Journal of Applied Business and Technology, 3(1), 17–25.

Ararat, M., Black, B. S, & Yurtoglu, B. B (2017). The effect of corporate governance on firm value and profitability: Time-series evidence from Turkey. Emerging Markets Review, 30, 113-132.

Astuti, P. D., & Datrini, L. K. (2021). Management Science Letters, Green competitive advantage: Examining the role of environmental consciousness and green intellectual capital. 11, 1141-1152.

Barney, J. B. (2008). Strategic management and competitive advantage: Concepts and cases. Pearson Prentice Hall.

Beneish, M. D. (1999). The detection of earnings manipulation. Financial Analysts Journal, 55(5), 24-36.

Brooks, C. (2019). Introductory econometrics for finance (4th ed.). Cambridge University Press.

Buallay, A., Hamdan, A., & Zureigat, Q. (2017). Corporate governance and firm performance: Evidence from Saudi Arabia. Australasian Accounting, Business and Finance Journal, 11(1), 78-98.

Chandra, T., Renaldo, N., Chandra, S., & Ng, M. (2024). Blue Management Accounting: Water Footprint, Cost, Efficiency, and Internal Control at WKP Corporation Headquarters. Journal of Environmental Accounting and Management, 12(2), 185–200. https://doi.org/10.5890/JEAM.2024.06.006

Chandra, T., Renaldo, N., & Putra, L. C. (2018). Stock Market Reaction towards SPECT Events using CAPM Adjusted Return. Opción, Año 34(Especial No.15), 338–374.

Chang, C. H., & Chen, Y. S. (2012). The determinants of green intellectual capital. Management Decision, 50(1), 74-94.

Chen, Y. S. (2008). The driver of green innovation and green image-green core competence. Journal of Business Ethics, 81(3), 531-543.

Chen, Y. S. (2011). Green organizational identity: Sources and consequence. Management Decision, 49(3), 384-404.

Chuang, S. P., & Huang, S. J. (2016). The effect of environmental corporate social responsibility on environmental performance and business competitiveness: The mediation of green information technology capital. Journal of Business Ethics, 150(4), 991-1009.

Dang, C., Li, Z. F., & Yang, C. (2018). Measuring firm size in empirical corporate finance. Journal of Banking & Finance, 86, 159-176.

Dangelico, R. M., & Pujari, D. (2010). Mainstreaming green product innovation: Why and how companies integrate environmental sustainability. Journal of Business Ethics, 95(3), 471-486.

Davidsson, P., Steffens, P., & Fitzsimmons, J. (2009). Growing profitable or growing from profits: Putting the horse in front of the cart? Journal of Business Venturing, 24(4), 388-406.

Deegan, C. (2002). The legitimising effect of social and environmental disclosures: A theoretical foundation. Accounting, Auditing & Accountability Journal, 15(3), 282-311.

DeAngelo, H., DeAngelo, L., & Skinner, D. J. (1994). Accounting choice in troubled companies. Journal of Accounting and Economics, 17(1-2), 113-143.

Dechow, P. M., & Dichev, I. D. (2002). The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review, 77(s-1), 35-59.

Fama, E. F., & French, K. R. (2015). A five-factor asset pricing model. Journal of Financial Economics, 116(1), 1-22.

Freeman, R. E., Harrison, J. S., Wicks, A. C., Parmar, B. L., & De Colle, S. (2017). Stakeholder theory: The state of the art. Cambridge University Press.

González, V. M. (2013). Leverage and corporate performance: International evidence. International Review of Economics & Finance, 25, 169-184.

Gujarati, D. N., & Porter, D. C. (2020). Basic econometrics (6th ed.). McGraw-Hill Education.

Hayes, A. F. (2018). Introduction to mediation, moderation, and conditional process analysis: A regression-based approach (2nd ed.). Guilford Press.

Healy, P. M., & Wahlen, J. M. (1999). A review of the earnings management literature and its implications for standard setting. Accounting Horizons, 13(4), 365-383.

IIRC. (2013). The international framework: Integrated reporting. The International Integrated Reporting Council.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

Junaedi, A. T., Renaldo, N., Yovita, I., Veronica, K., & Jahrizal. (2024). Digital Culture Revolution in Improving Firm Performance in Indonesia. Journal of System and Management Sciences, 14(1), 452–470. https://doi.org/10.33168/JSMS.2024.0126

Kao, M. F., Hodgkinson, L., & Jaafar, A. (2019). Ownership structure, board of directors and firm performance: Evidence from Taiwan. Corporate Governance: The International Journal of Business in Society, 19(1), 189-216.

Leuz, C., Nanda, D., & Wysocki, P. D. (2003). Earnings management and investor protection: An international comparison. Journal of Financial Economics, 69(3), 505-527.

McKelvie, A., & Wiklund, J. (2010). Advancing firm growth research: A focus on growth mode instead of growth rate. Entrepreneurship Theory and Practice, 34(2), 261-288.

Mersni, H., & Ben Othman, H. (2016). The impact of corporate governance mechanisms on earnings management in Islamic banks in the Middle East region - Journal of Islamic Accounting and Business Research, 7(4), 318-348.

Renaldo, N., Andi, Nur, N. M., Junaedi, A. T., & Panjaitan, H. P. (2021). Determinants of Firm Value for Wholesale Sub-sector Companies in 2016-2019 with Behavioral Accounting Approach. Journal of Applied Business and Technology, 2(1), 1–12. https://doi.org/https://doi.org/10.35145/jabt.v2i1.55

Renaldo, N., & Murwaningsari, E. (2023). Does Gender Diversity Moderate the Determinant of Future Firm Value? Review of Economics and Finance, 21, 680–689. https://doi.org/https://doi.org/10.55365/1923.x2023.21.72

Renaldo, N., Rozalia, D. K., Musa, S., Wahid, N., & Cecilia. (2023). Current Ratio, Firm Size, and Return on Equity on Price Earnings Ratio with Dividend Payout Ratio as a Moderation and Firm Characteristic as Control Variable on the MNC 36 Index Period 2017-2021. Journal of Applied Business and Technology, 4(3), 214–226. https://doi.org/10.35145/jabt.v4i3.136

Renaldo, N., Suhardjo, Suharti, Suyono, & Cecilia. (2022). Benefits and Challenges of Technology and Information Systems on Performance. Journal of Applied Business and Technology, 3(3), 302–305. https://doi.org/https://doi.org/10.35145/jabt.v3i3.114

Sharma, S., Durand, R. M., & Gur-Arie, O. (1981). Identification and analysis of moderator variables. Journal of Marketing Research, 18(3), 291-300.

Skinner, D. J., & Sloan, R. G. (2002). Earnings surprises, growth expectations, and stock returns or don't let an earnings torpedo sink your portfolio. Review of Accounting Studies, 7(2-3), 289-312.

Song, W., & Yu, H. (2017). Green innovation strategy and green innovation: The roles of green creativity and green organizational identity. Corporate Social Responsibility and Environmental Management, 25(2), 135-150.

Spence, M. (1973). Job market signaling. The Quarterly Journal of Economics, 87(3), 355-374.

Suyono, Sudarno, Suhardjo, Sari, Y., & Purnama, I. (2020). The influence of price to book value on capital structure and profitability of health and pharmaceutical companies in Indonesia. Journal of Applied Business and Technology, 1(3), 181–187.

Yusoff, Y. M., Omar, M. K., & Kamarudin, M. D. (2019). Practice of green intellectual capital: Evidence from Malaysian manufacturing sector. IOP Conference Series: Materials Science and Engineering, 469, 012115.

Zulkifli, Z., Purwati, A. A., Renaldo, N., Hamzah, Z., & Hamzah, M. L. (2023). Employee performance of Sharia Bank in Indonesia : The mediation of organizational innovation and knowledge sharing. Cogent Business & Management, 10(3), 1–25. https://doi.org/10.1080/23311975.2023.2273609