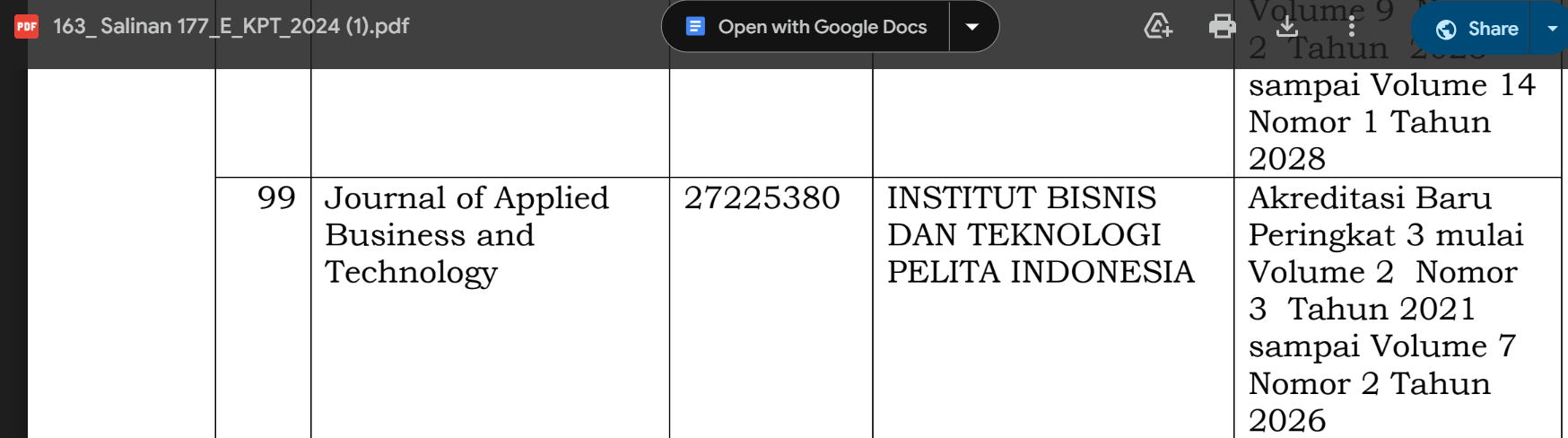

The Effect of Market Power and Systematic Risk on Future Earnings Response Coefficient with Tax Compliance as a Moderation

DOI:

https://doi.org/10.35145/jabt.v5i3.191Keywords:

FERC, Tax Compliance, Systematic Risk, Market PowerAbstract

This study aims to analyze the influence of market power and systematic risk on the future earnings response coefficient (ERC), with tax compliance as a moderating factor. In this context, the study will examine how market power and systematic risk affect market reactions to future earnings, considering the role of tax compliance as a moderating factor. Relevant references for this study include factor analysis that influences ERC in financial sector companies, the influence of size, leverage, and profitability on FERC, and market response. Thus, this study will provide an in-depth understanding of how these factors are interrelated and impact market reactions to future earnings, with tax compliance as an important moderating factor. This study aims to analyze the influence of market power and systematic risk on the future earnings response coefficient (ERC), with tax compliance as a moderating factor. In this context, the study will examine how market power and systematic risk affect market reactions to future earnings, considering the role of tax compliance as a moderating factor. Relevant references for this study include factor analysis that influences ERC in financial sector companies, the influence of size, leverage, and profitability on FERC, and market response. Thus, this study will provide an in-depth understanding of how these factors are interrelated and impact market reactions to future earnings, with tax compliance as an important moderating factor.

References

Aini, AO, Budiman, J., & Wijayanti, P. (2014). Tax Compliance of Manufacturing Companies in Semarang in the Perspective of Tax Professionals. InFestasi (Journal of Business and Accounting), 10(1), 22-35.

Collins, DW, SP Kothari, Shanken, J and Sloan, R. (1994). "Lack of Timeliness and Noise as Explanations for the Contemporaneous Low Return-Earning Association". Journal of Accounting and Economics.18: 289-324.

E Murwaningsari (2013). The Effect of Growth Opportunities and Long-Term Investment on Leverage and Future Earnings Response Coefficient. Business and Management Research Media, 3(1), 1-19.

E Murwaningsari (2014). The Effect of Institutional Ownership and Audit Quality on Information Disclosure and Future Earnings Response Coefficient. Journal of Finance and Banking, 18(2), 1-19.

EPM Pradhana, E Murwaningsari (2014). The Influence of Market Power and Corporate Governance on Future Earnings Response Coefficient in Companies on the Indonesia Stock Exchange. Trisakti Accounting Journal, 1(1), 1-19.

Ghozali, I. (2018). Multivariate Analysis Application With IBM SPSS 25 (Nine) Program. In Semarang, Diponegoro University.

Ginting, G. (2021). Investment and Capital Structure. CV. Azka Pustaka.

Indraswono, C. (2015). The Influence of Institutional Ownership Structure, Company Size and Legal Origin on Earnings Management. Journal of Business Accounting, 13(26), 145-173.

ISTIANINGSIH, ISTIANINGSIH and TRIREKSANI, TERRI and MANURUNG, DANIEL TH (2020) The Impact of Corporate Social Responsibility Disclosure on the Future Earnings Response Coefficient (ASEAN Banking Analysis). MDPI AG. (Unpublished)

Mangoting, Y. (2018). Quo Vadis Tax Compliance? Multiparadigma Accounting Journal, 9(3), 451-470. https://doi.org/10.18202/jamal.2018.04.9027

Mulyani, Asyik, Andayani (2007). Factors Affecting Earnings Response Coefficient in Companies Listed on the Jakarta Stock Exchange. JAAI, Volume 11, No. 1, pp. 35-45

Pradhana, EPM, & Murwaningsari, E. (2014). The Influence of Market Power and Corporate Governance on Future Earnings Response Coefficient in Companies on the Indonesia Stock Exchange. Trisakti Accounting Journal, 1(1), 1-19.

Prastiwi, D., Narsa, IM, & Tjaraka, H. (2019). Tax Accounting System System. Multiparadigma Accounting Journal, 10(2), 276-294. https://doi.org/10.18202/jamal.2019.08.10016

Prasetyo, A., Andayani, E., & Sofyan, M. (2020). Financial Report Bookkeeping Training Guidance for MSME Taxpayers in Jakarta. JOURNAL OF ECONOMICS, MANAGEMENT, BUSINESS, AND SOCIAL SCIENCES (EMBISS), 1(1), 34–39.

Sulistywati, AI, Lestari, DIT, & Tiandari, NW (2012). The Influence of Taxpayer Awareness, Tax Services and Taxpayer Compliance on Tax Revenue Performance (Case Study at Semarang Candisari Pratama Tax Service Office). Infestaso Journal, 8(1), 81–96. https://doi.org/10.21107/infestasi.v8i1.1256

Sujana, IN (2015). Systematic Risk: Variables that Influence. Equity: Journal of Economic Education, 3(1).

Tan, E., & Pradita, AA (2020). The Influence of Internal Factors, Sanctions and Modernization of Tax Administration on Corporate Taxpayer Compliance. Journal of Entrepreneurial Development, 22(02), 103.

Tarmidi, Deden. (2020). The Effect of Tax Compliance and Earnings Quality on the Future Earnings Response Coefficient with Financial Performance as a Mediator

Ware, R., & Church, J. 2000. Industrial Organization: A Strategic Approach.

Wiguna, S., & Murwaningsari, E. (2022). The Effect of Systematic Risk, Operating Cash Flow and Growth Opportunities on Future Earnings Response Coefficients (FERC), Working Capital as A Moderation Variable. International Journal of Social and Management Studies, 3(2), 34-45.